In news– Maharashtra may become the 8th state to opt out of Pradhan Mantri Fasal Bima Yojana (PMFBY).

Key updates-

- Andhra Pradesh, Jharkhand, Telangana, Bihar, Gujarat, Punjab and West Bengal — all predominantly agriculture states — have already opted out of the scheme.

- Some of these states have their own insurance schemes.

- Maharashtra may replace the central scheme with its own — a step already adopted by states like West Bengal.

- The two major issues identified by the Maharashtra government are denial and delay of claims along with a huge subsidy burden on state governments.

- Moreover, the revamped guidelines on premium share have increased the burden.

- The full central share in the premium subsidy will be applicable only up to actuarial premium rate (APR) of 25 per cent and 30 per cent for irrigated and rainfed areas/district respectively.

- This means that for a particular irrigated crop, if the premium rate is above 25 per cent for irrigated area and above 30 per cent for unirrigated or rainfed areas, the state has to contribute over and above that part.

- The model of crop insurance in place in Maharashtra’s Beed district is also being studied by a central government panel set up to suggest suitable working models for PMFBY.

About Pradhan Mantri Fasal Bima Yojana (PMFBY)-

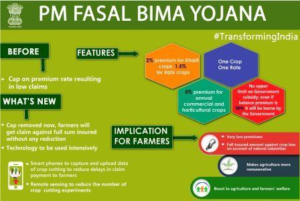

- Launched in 2016, PMFBY is an insurance service for farmers for their yields.

- PMFBY insures farmers against all non-preventable natural risks from pre-sowing to post-harvest.

- Farmers have to pay a maximum of 2 percent of the total premium of the insured amount for kharif crops, 1.5 per cent for rabi food crops and oilseeds as well as 5 per cent for commercial / horticultural crops.

- All farmers growing notified crops in a notified area during the season who have insurable interest in the crop are eligible.

- The scheme has been made voluntary for all farmers from Kharif 2020.

- It replaced the existing two schemes National Agricultural Insurance Scheme as well as the Modified NAIS.

- Objectives:

- To provide insurance coverage and financial support to the farmers in the event of failure of any of the notified crops as a result of natural calamities, pests & diseases.

- To stabilize the income of farmers to ensure their continuance in farming.

- To encourage farmers to adopt innovative and modern agricultural practices.

- To ensure flow of credit to the agriculture sector.

- The balance premium is shared by the Union and state governments on a 50:50 basis and on a 90:10 basis in the case of northeastern states.

- Claims are worked out on the basis of shortfall in actual yield, vis-a-vis the threshold yield in the notified area.

Further reading: https://journalsofindia.com/five-years-of-the-pradhan-mantri-fasal-bima-yojana/