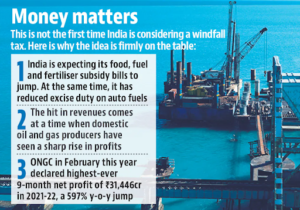

In news- The Union government has recently imposed an export tax on petrol, diesel and jet fuel and joined nations like the UK in imposing a windfall tax on crude oil produced locally.

About the windfall tax-

- In a bid to regulate domestic crude oil producers from importing crude and then selling it at international parity prices, a windfall tax has been imposed.

- It also aims to address the issue of fuel shortage in the country.

- The government stated that the domestic crude producers sell crude to domestic refineries at international parity prices. As a result, the domestic crude producers are making windfall gains.

- Taking this into account, a cess of Rs 23,250 per tonne by way of special additional excise duty or windfall tax has been imposed on crude.

- A special additional excise duty (SAED) of Rs 6 per litre has also been imposed on exports of Aviation Turbine Fuel.

- Also, the Directorate General of Foreign Trade (DGFT) has imposed an export policy condition that exporters would be required to declare at the time of export that 50% of the quantity mentioned in the shipping bill has been/ will be supplied in the domestic market during the current fiscal.

Impact-

- These measures would not have any adverse impact on domestic retail prices of diesel and petrol. Thus, domestic retail prices would remain unchanged.

- At the same time these measures will ensure domestic availability of the petroleum products.

- The move will not just fetch more revenue to the exchequer but also discourage companies from exporting petrol and diesel, and thereby help ease the fuel situation in the domestic market.