The Finance Minister said that for a USD 5 trillion economy, our manufacturing sector has to grow in double digits on a sustained basis. Our manufacturing companies need to become an integral part of global supply chains, possess core competence and cutting-edge technology.

Aatma Nirbhar Bharat-Production Linked Incentive (PLI) Scheme:

- To achieve all of the above, PLI schemes to create manufacturing global champions for an Aatma Nirbhar Bharat have been announced for 13 sectors.

- For this, the government has committed nearly Rs.1.97 lakh crore in the next 5 years starting FY 2021-22.

- This initiative will help bring scale and size in key sectors, create and nurture global champions and provide jobs to our youth.

Textiles: Mega Investment Textiles Parks (MITRA) scheme:

- Similarly, to enable the textile industry to become globally competitive, attract large investments and boost employment generation, a scheme of Mega Investment Textiles Parks (MITRA) will be launched in addition to the PLI scheme.

- This will create world class infrastructure with plug and play facilities to enable creation of global champions in exports. 7 Textile Parks will be established over 3 years.

Infrastructure

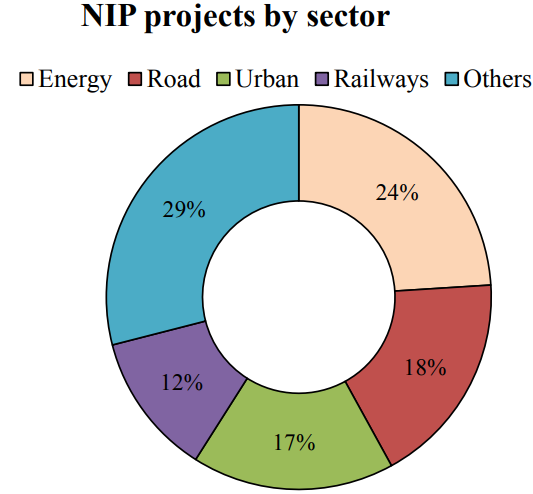

- The National Infrastructure Pipeline (NIP) which the Finance Minister announced in December 2019 is the first-of-its-kind, whole-of-government exercise ever undertaken.

- The NIP was launched with 6835 projects; the project pipeline has now expanded to 7,400 projects.

- Around 217 projects worth Rs 1.10 lakh crore under some key infrastructure Ministries have been completed.

Infrastructure financing – Development Financial Institution (DFI)

- Dwelling on the infrastructure sector, the Finance Minister said that infrastructure needs long term debt financing.

- A professionally managed Development Financial Institution is necessary to act as a provider, enabler and catalyst for infrastructure financing.

- Accordingly, a Bill to set up a DFI will be introduced. Government has provided a sum of Rs 20,000 crore to capitalise this institution and the ambition is to have a lending portfolio of at least Rs 5 lakh crore for this DFI in three years time.

Asset Monetisation

- Monetizing operating public infrastructure assets is a very important financing option for new infrastructure construction.

- A “National Monetization Pipeline” of potential Brownfield infrastructure assets will be launched.

- An Asset Monetization dashboard will also be created for tracking the progress and to provide visibility to investors. Some important measures in the direction of monetisation are:

- National Highways Authority of India and PGCIL each have sponsored one InvIT that will attract international and domestic institutional investors.

- Five operational roads with an estimated enterprise value of Rs 5,000 crore are being transferred to the NHAI InvIT.

- Similarly, transmission assets of a value of Rs 7,000 crore will be transferred to the PGCIL InvIT.

- Railways will monetize Dedicated Freight Corridor assets for operations and maintenance, after commissioning.

- The next lot of Airports will be monetised for operations and management concession.

- Other core infrastructure assets that will be rolled out under the Asset Monetization Programme are:

- NHAI Operational Toll Roads

- Transmission Assets of PGCIL

- Oil and Gas Pipelines of GAIL, IOCL and HPCL

- AAI Airports in Tier II and III cities

- Other Railway Infrastructure Assets

- Warehousing Assets of CPSEs such as Central Warehousing Corporation and NAFED among others and

- Sports Stadiums.

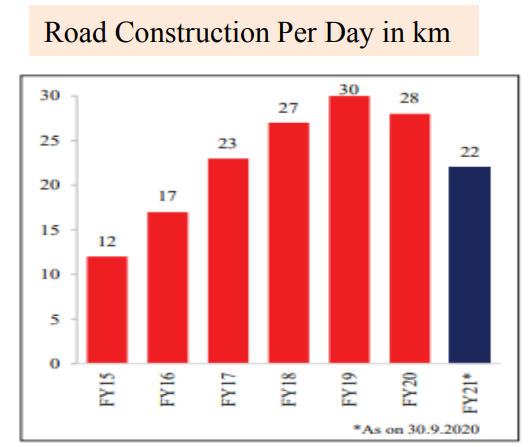

Roads and Highways Infrastructure

- Finance Minister announced that more than 13,000 km length of roads, at a cost of Rs 3.3 lakh crore, has already been awarded under the Rs. 5.35 lakh crore Bharatmala Pariyojana project of which 3,800 kms have been constructed.

- By March 2022, the Government would be awarding another 8,500 kms and completing an additional 11,000 kms of national highway corridors.

- To further augment road infrastructure, more economic corridors are also being planned.

- The Minister also provided an enhanced outlay of Rs. 1,18,101 lakh crore for the Ministry of Road Transport and Highways, of which Rs.1,08,230 crore is for capital, the highest ever.

Railway Infrastructure

- Indian Railways have prepared a National Rail Plan for India – 2030.

- The Plan is to create a ‘future ready’ Railway system by 2030.

- Bringing down the logistic costs for our industry is at the core of our strategy to enable ‘Make in India’.

- It is expected that Western Dedicated Freight Corridor (DFC) and Eastern DFC will be commissioned by June 2022.

- For Passenger convenience and safety the following measures are proposed:

- Introduction of aesthetically designed Vista Dome LHB coach on tourist routes to give a better travel experience to passengers.

- The safety measures undertaken in the past few years have borne results.

- To further strengthen this effort, high density network and highly utilized network routes of Indian railways will be provided with an indigenously developed automatic train protection system that eliminates train collision due to human error.

- Budget also provided a record sum of Rs. 1,10,055 crore, for Railways of which Rs. 1,07,100 crore is for capital expenditure.

Urban Infrastructure

Government will work towards raising the share of public transport in urban areas through expansion of the metro rail network and augmentation of city bus service. A new scheme will be launched at a cost of Rs. 18,000 crore to support augmentation of public bus transport services.

A total of 702 km of conventional metro is operational and another 1,016 km of metro and RRTS is under construction in 27 cities.

Two new technologies i.e., ‘MetroLite’ and ‘MetroNeo’ will be deployed to provide metro rail systems at much lesser cost with the same experience, convenience and safety in Tier-2 cities and peripheral areas of Tier-1 cities.

Power Infrastructure

- The past 6 years have seen a number of reforms and achievements in the power sector with the addition of 139 Giga Watts of installed capacity, connecting an additional 2.8 crore households and addition of 1.41 lakh circuit km of transmission lines.

- Expressing a serious concern over the viability of Distribution Companies, the Finance Minister proposed to launch a revamped reforms-based result-linked power distribution sector scheme with an outlay of Rs. 3,05,984 crore over 5 years.

- The scheme will provide assistance to DISCOMS for Infrastructure creation including pre-paid smart metering and feeder separation, upgradation of systems, etc., tied to financial improvements.

Ports, Shipping, Waterways

- Major Ports will be moving from managing their operational services on their own to a model where a private partner will manage it for them.

- For the purpose the budget proposes to offer more than Rs. 2,000 crore by Major Ports on Public Private Partnership mode in FY 21-22.

- A scheme to promote flagging of merchant ships in India will be launched by providing subsidy support to Indian shipping companies in global tenders floated by Ministries and CPSEs. An amount of Rs. 1624 crore will be provided over 5 years.

- This initiative will enable greater training and employment opportunities for Indian seafarers besides enhancing Indian companies’ share in global shipping.

Petroleum & Natural Gas

The Finance Minister said that the government has kept fuel supplies running across the country without interruption during the COVID-19 lockdown period. Taking note of the crucial nature of this sector in people’s lives, the following key initiatives are being announced:

- Ujjwala Scheme which has benefited 8 crore households will be extended to cover 1 crore more beneficiaries.

- Government will add 100 more districts in the next 3 years to the City Gas Distribution network.

- A gas pipeline project will be taken up in Union Territory of Jammu & Kashmir.

- An independent Gas Transport System Operator will be set up for facilitation and coordination of booking of common carrier capacity in all-natural gas pipelines on a non-discriminatory open access basis.

Financial Capital

The Finance Minister proposed to consolidate the provisions of SEBI Act, 1992, Depositories Act, 1996, Securities Contracts (Regulation) Act, 1956 and Government Securities Act, 2007 into a rationalized single Securities Markets Code. The Government would support the development of a world class Fin-Tech hub at the GIFT-IFSC.

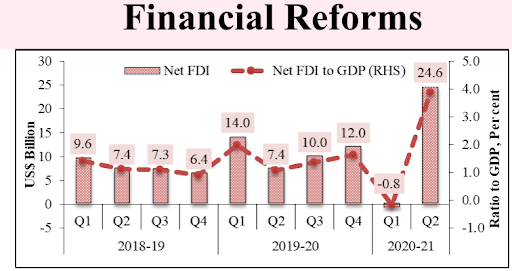

Increasing FDI in Insurance Sector

The Minister also proposed to amend the Insurance Act, 1938 to increase the permissible FDI limit from 49% to 74% and allow foreign ownership and control with safeguards.

Under the new structure, the majority of Directors on the Board and key management persons would be resident Indians, with at least 50% of Directors being Independent Directors, and specified percentage of profits being retained as general reserve.

Stressed Asset Resolution by setting up a New Structure

The high level of provisioning by public sector banks of their stressed assets calls for measures to clean up the bank books. An Asset Reconstruction Company Limited and Asset Management Company would be set up to consolidate and take over the existing stressed debt and then manage and dispose of the assets to Alternate Investment Funds and other potential investors for eventual value realization.

Recapitalization of PSBs:

To further consolidate the financial capacity of PSBs, further recapitalization of `20,000 crores is proposed in 2021-22.

Deposit Insurance:

Government had approved an increase in the Deposit Insurance cover from Rs. 1 lakh to Rs. 5 lakhs for bank customers.

Company Matters:

The decriminalizing of the procedural and technical compoundable offences under the Companies Act, 2013, is now complete. Now the Minister proposes to next take up decriminalization of the Limited Liability Partnership (LLP) Act, 2008.

Disinvestment and Strategic Sale

The Finance Minister said a number of transactions namely BPCL, Air India, Shipping Corporation of India, Container Corporation of India, IDBI Bank, BEML, Pawan Hans, NeelachalIspat Nigam limited among others would be completed in 2021-22. Other than IDBI Bank, Government proposes to take up the privatization of two Public Sector Banks and one General Insurance company in the year 2021-22.

In 2021-22, Government would also bring the IPO of LIC for which the requisite amendments will be made in this Session itself.

AtmaNirbhar Package

- In a very important announcement, the Finance Minister said that in the AtmaNirbhar Package, she had announced to come out with a policy of strategic disinvestment of public sector enterprises and said that the Government has approved the said policy.

- The policy provides a clear roadmap for disinvestment in all non-strategic and strategic sectors.

- Government has kept four areas that are strategic where bare minimum CPSEs will be maintained and rest privatized.

- In the non-strategic sectors, CPSEs will be privatised, otherwise shall be closed.

- She said that to fast forward the disinvestment policy, NITI Aayog will work out on the next list of Central Public Sector companies that would be taken up for strategic disinvestment.

- Government has estimated Rs. 1,75,000 crore as receipts from disinvestment in BE 2020-21 .