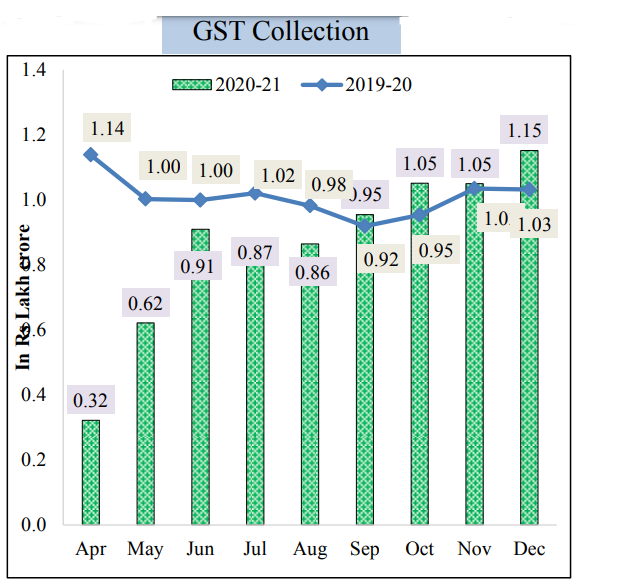

On the issue of Indirect Tax proposals, the Minister said that record GST collections have been made in the last few months. She said several measures have been taken to further simplify the GST. The capacity of the GSTN system has been announced.

Custom Duty Rationalization:

- With respect to the custom duty policy, the Finance Minister said that it has the twin objectives of promoting domestic manufacturing and helping India get on to global value change and export better.

- She said that the thrust now has to be on easy access to raw materials and exports of value added products

- In this regard, she proposed to review 400 old exemptions in the custom duty structure this year. She announced that extensive consultation will be conducted and from 1st October, 2021, a revised custom duty structure free of distortions will be put in place

- New customs duty exemptions to have validity up to the 31st March following two years from its issue date

Electronic and Mobile Phone Industry:

The Finance Minister announced withdrawal of a few exemptions on parts of chargers and sub-parts of mobile phones further some parts of mobiles will move from “NIL” rate to a moderate 2.5 per cent.

Iron and Steel:

- She also announced reducing custom duty uniformly to 7.5 per cent on semis, flat, and long products of non-alloy and stainless steel.

- She also announced exempting duty on steel scrap for a period upto 31st March 2022.

- Anti-Dumping Duty (ADD) and Countervailing Duty (CVD) revoked on certain steel products

- Duty on copper scrap reduced from 5% to 2.5%

Textiles:

Announcing uniform deduction of the BCD rates on Caprolactam, nylon chips and nylon fiber and yarn to 5 per cent, the Minister said this will help the textile industry, MSMEs and exports too.

Basic Customs Duty (BCD) on caprolactam, nylon chips and nylon fiber & yarn reduced to 5%

Chemicals:

- She also announced calibration of customs duty rate on chemical to encourage domestic value addition and to remove inversions.

- Duty on Naphtha reduced to 2.5%

Gold and Silver:

The Minister also announced rationalization of custom duty on gold and silver.

Renewable Energy:

- The Finance Minister said that a phased manufacturing plan for solar cells and solar panels will be notified to build up domestic capacity.

- She announced raising duty on solar inverters from 5 per cent to 20 percent and on solar lanterns from 5 per cent to 15 per cent.

Capital Equipment:

- Tunnel boring machine to now attract a customs duty of 7.5%; and its parts a duty of 2.5%

- Duty on certain auto parts increased to general rate of 15%

MSME Products:

The Budget proposes certain changes to benefit MSMEs which include:

- Duty on steel screws and plastic builder wares increased to 15%

- Prawn feed to attract customs duty of 15% from earlier rate of 5%

- Exemption on import of duty-free items rationalized to incentivize exporters of garments, leather, and handicraft items

- Exemption on imports of certain kind of leathers withdrawn

- Customs duty on finished synthetic gemstones raised to encourage domestic processing

Agriculture Products:

To benefit farmers, the Finance Minister announced;

- Customs duty on cotton increased from nil to 10% and on raw silk and silk yarn from 10% to 15%.

- Withdrawal of end-use based concession on denatured ethyl alcohol

- Agriculture Infrastructure and Development Cess (AIDC) on a small number of items

Rationalization of Procedures and Easing of Compliance:

- Regarding rationalization of procedures and easing of compliance, the Finance Minister proposed certain changes in the provisions relating to ADD and CVD levies.

- Turant Customs initiative, a Faceless, Paperless, and Contactless Customs measures

- New procedure for administration of Rules of Origin