- Central theme of ECONOMIC SURVEY 2021-22 is the “AGILE APPROACH” implemented through India’s economic response to the COVID-19 Pandemic shock. Another theme highlighted in the Economic Survey relates to the art and science of policy-making under conditions of extreme uncertainty resulting from the COVID-19 pandemic.

- For more than a decade after the 1st Survey, the Survey document has been clubbed with the Union Budget. Making a shift from the two-volume format of recent years, this year’s Survey reverts to a single volume plus a separate volume for the Statistical Appendix. Along with the sectoral chapters, this year’s Survey adds a new chapter that demonstrates the use of satellite and geo-spatial images to gauge various economic phenomena – urbanization, infrastructure, environmental impact, farming practices and so on.

- An important theme that has been discussed through the course of the Economic Survey is that of ‘process reforms’. It is different from deregulation. The latter relates to reducing or removing the role of government from a particular activity. In contrast, the process reforms are broadly related to simplification and smoothening of the process for activities where the government’s presence as a facilitator or regulator is necessary.

- Faced with challenges post-pandemic, the Government of India opted for a “Barbell Strategy” that combined a bouquet of safety-nets to cushion the impact on vulnerable sections of society and the business sector. It next pushed through a significant increase in capital expenditure on infrastructure to build back medium-term demand as well as aggressively implemented supply-side measures to prepare the economy for the sustained long-term expansion. This flexible and multi-layered approach is partly based on an “Agile” framework that uses feedback-loops, and the monitoring of real-time data.

Highlights of Survey 2021-2022-

State of the Economy:

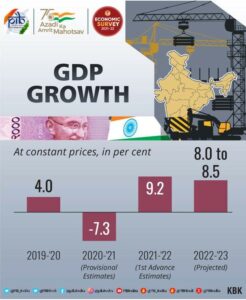

- India to witness GDP growth of 8.0-8.5 per cent in 2022-23, supported by widespread vaccine coverage, normal monsoons, gains from supply-side reforms and easing of regulations, robust export growth, and availability of fiscal space to ramp up capital spending.

- The above projection is comparable with the World Bank’s and Asian Development Bank’s latest forecasts of real GDP growth of 8.7 per cent and 7.5 per cent respectively for 2022-23. As per the IMF’s latest World Economic Outlook (WEO) growth projections, India’s real GDP is projected to grow at 9 percent in both 2021-22 and 2022-23 and at 7.1 per cent in 2023-24. This projects India as the fastest growing major economy in the world in all these three years.

- Referring to First Advance Estimates (FAE), the Survey states that the Indian economy is estimated to grow by 9.2 per cent in real terms in 2021-22, after a contraction of 7.3 per cent in 2020-21. Almost all indicators show that the economic impact of the “second wave” in Q1 was much smaller than that experienced during the full lockdown phase in 2020-21, even though the health impact was more severe.

Fiscal Developments:

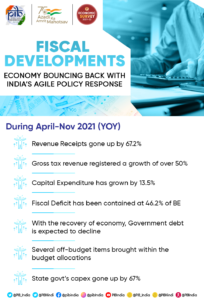

- The revenue receipts (April to November, 2021) have gone up by 67.2 percent (YoY) as against an expected growth of 9.6 percent in the 2021-22 Budget Estimates.

- Gross Tax Revenue registered a growth of over 50 percent during April to November, 2021 in YoY terms.

- During April-November 2021, Capital expenditure has grown by 13.5 percent (YoY) with focus on infrastructure-intensive sectors.

- Sustained revenue collection and a targeted expenditure policy has contained the fiscal deficit for April to November, 2021 at 46.2 percent of BE.

- With the enhanced borrowings on account of COVID-19, the Central Government debt has gone up from 49.1 percent of GDP in 2019-20 to 59.3 percent of GDP in 2020-21, but is expected to follow a declining trajectory.

- The tax collections have been buoyant for both direct and indirect taxes and the gross monthly GST collections have crossed Rs 1 lakh crore consistently since July 2021.

- The fiscal deficit for April-November 2021 has been contained at 46.2 percent of Budget Estimates (BE) which is nearly one third of the proportion reached during the same period of the previous two years (135.1% of BE in April-November 2020 and 114.8% of BE in April-November 2019).

External Sectors:

- Net capital flows were higher on account of continued inflow of foreign investment, revival in net external commercial borrowings, higher banking capital and additional special drawing rights (SDR) allocation.

- India’s total exports are expected to grow by 16.5 per cent in 2021-22 surpassing pre-pandemic levels.

- Imports are expected to grow by 29.4 per cent in 2021-22 surpassing corresponding pre-pandemic levels.

- Resultantly, India’s net exports have turned negative in the first half of 2021-22, compared to a surplus in the corresponding period of 2020-21.

- But the current account deficit (CAD) is expected to remain within manageable limits.

- Despite all the disruptions caused by the global pandemic, India’s Balance of payments (BoP) remained in surplus throughout the last two years (US$ 63.1 billion in first-half of 2021-22).

- This allowed the RBI to keep accumulating foreign exchange reserves, which stand at US$ 634 billion on 31st December 2021.

- As of end-November 2021, India was the fourth largest forex reserves holder in the world after China, Japan and Switzerland.

- India’s external debt rose to US $ 593.1 billion at end-September 2021, from US $ 556.8 billion a year earlier, reflecting additional SDR allocation by the IMF, coupled with higher commercial borrowings.

Monetary Management and Financial Intermediation:

- Repo rate was maintained at 4 per cent in 2021-22.

- RBI undertook various measures such as G-Sec Acquisition Programme and Special Long-Term Repo Operations to provide further liquidity.

- The Gross Non-Performing Advances ratio of Scheduled Commercial Banks (SCBs) declined from 11.2 percent at the end of 2017-18 to 6.9 percent at the end of September, 2021.

- Net Non-Performing Advances ratio declined from 6 percent to 2.2 percent during the same period.

- Capital to Risk weighted asset ratio of SCBs – 13% (2013-14) to 16.54% (September 2021).

- 89,066 crore was raised via 75 Initial Public Offering (IPO) issues in April-November 2021, which is much higher than in any year in the last decade.

- Sensex and Nifty scaled up to touch peaks at 61,766 and 18,477 on October 18, 2021.

- Among major emerging market economies, Indian markets outperformed peers in April-December 2021.

- Another distinguishing feature of India’s economic response has been an emphasis on supply-side reforms rather than a total reliance on demand management. These supply-side reforms include deregulation of numerous sectors, simplification of processes, removal of legacy issues like ‘retrospective tax’, privatization, production-linked incentives and so on.

The two common themes in India’s supply-side strategy:

- Reforms that improve flexibility and innovation that includes factor market reforms; deregulation of sectors like space, drones, geospatial mapping, trade finance factoring; process reforms like those in government procurement and in telecommunications sector; removal of legacy issues like retrospective tax; privatization and monetization, creation of physical infrastructure, and so on.

- Reforms aimed at improving the resilience of the Indian economy, ranging from climate/environment related policies; social infrastructure; support for key industries under Atma Nirbhar Bharat; a strong emphasis on reciprocity in foreign trade agreements, and so on.

Prices and Inflation:

- In India, Consumer Price Index (CPI) inflation moderated to 2 per cent in 2021-22 (April-December) from 6.6 per cent in the corresponding period of 2020-21.

- It was 6 per cent (YoY) in December 2021, which is within the targeted tolerance band.

- The decline in retail inflation in 2021-22 was led by easing of food inflation.

- Food inflation reduced to 2.9% in April-December 2021 against 9.1% last year.

- Reduction in central excise and subsequent cuts in Value Added Tax by most States helped ease petrol and diesel prices.

- Wholesale inflation based on Wholesale Price Index (WPI) rose to 12.5 percent during 2021-22 (April to December).

- Divergence between CPI-C and WPI Inflation peaked to 9.6 percentage points in May 2020.

- However, this year there was a reversal in divergence with retail inflation falling below wholesale inflation by 8.0 percentage points in December 2021 due to factors such as:

- Variations due to base effect,

- Difference in scope and coverage of the two indices,

Price collections,

Price collections,- Items covered,

- Difference in commodity weights, and

- WPI being more sensitive to cost-push inflation led by imported inputs.

Sustainable Development and Climate Change:

- India’s overall score on the NITI Aayog SDG India Index and Dashboard improved to 66 in 2020-21 from 60 in 2019-20 and 57 in 2018-19.

- Number of Front Runners (scoring 65-99) increased to 22 States and UTs in 2020-21 from 10 in 2019-20.

- In North East India, 64 districts were Front Runners and 39 districts were Performers in the NITI Aayog North-Eastern Region District SDG Index 2021-22.

- India has the tenth largest forest area in the world.

- In 2020, India ranked third globally in increasing its forest area during 2010 to 2020.

- In 2020, the forests covered 24% of India’s total geographical area, accounting for 2% of the world’s total forest area.

- In August 2021, the Plastic Waste Management Amendment Rules, 2021, was notified which is aimed at phasing out single use plastic by 2022.

- Draft regulation on Extended Producer Responsibility for plastic packaging was notified.

- The Compliance status of Grossly Polluting Industries (GPIs) located in the Ganga main stem and its tributaries improved from 39% in 2017 to 81% in 2020.

- At the 26th Conference of Parties (COP 26) in Glasgow in November 2021, the need to start the one-word movement ‘LIFE’ (Lifestyle for Environment) urging mindful and deliberate utilization instead of mindless and destructive consumption was underlined.

Agriculture and Food Management:

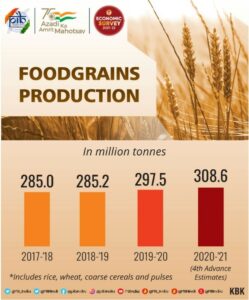

- The Agriculture sector experienced buoyant growth in the past two years, accounting for a sizable 8% (2021-22) in Gross Value Added (GVA) of the country registering a growth of 3.6% in 2020-21 and 3.9% in 2021-22.

- The area sown under Kharif and Rabi crops and the production of wheat and rice has been steadily increasing over the years.

- In the current year, food grains production for the Kharif season is estimated to post a record level of 150.5 million tonnes.

- Minimum Support Price (MSP) policy is being used to promote crop diversification.

- Net receipts from crop production have increased by 22.6% in the latest Situation Assessment Survey (SAS) compared to the SAS Report of 2014.

- Allied sectors including animal husbandry, dairying and fisheries are steadily emerging to be high growth sectors and major drivers of overall growth in the agriculture sector.

- The Livestock sector has grown at a CAGR of 8.15% over the last five years ending 2019-20.

- India runs one of the largest food management programmes in the world.

- Government has further extended the coverage of the food security network through schemes like PM Gareeb Kalyan Yojana (PMGKY).

Industry and Infrastructure:

- The industrial sector went through a sharp rebound from a contracti

on of 7 per cent in 2020-21 to an expansion of 11.8 percent in this financial year.

on of 7 per cent in 2020-21 to an expansion of 11.8 percent in this financial year.- The share of industry in GVA is now estimated at 28.2 per cent.

- The Index of Industrial Production (IIP) grew at 17.4 percent (YoY) during April-November 2021 as compared to (-)15.3 percent in April-November 2020.

Introduction of Production Linked Incentive (PLI) scheme, major boost provided to infrastructure-both physical as well as digital, along with measures to reduce transaction costs and improve ease of doing business, would support the pace of recovery.

Services:

- The Survey states that the Services sector has been the hardest hit by the pandemic, especially segments that involve human contact.

- This sector is estimated to grow by 8.2 per cent this financial year following last year’s 8.4 per cent contraction.

- The finance /Real Estate and the Public Administration segments are now well above pre-COVID levels.

- During the first half of 2021-22, the service sector received over US$ 16.7 billion FDI – accounting for almost 54 percent of total FDI inflows into India.

- Major government reforms include, removing telecom regulations in the IT-BPO sector and opening up of the space sector to private players.

- Services exports surpassed pre-pandemic level in January-March quarter of 2020-21 and grew by 21.6 percent in the first half of 2021-22.

- India has become the 3rd largest start-up ecosystem in the world after the US and China.

- Number of new recognized start-ups increased to over 14000 in 2021-22 from 733 in 2016-17.

- Delhi has replaced Bengaluru as the startup capital of India and with a total of 11,308 startups, Maharashtra has the highest number of recognized startups in the country.

Social Infrastructure, Employment and Human Development:

- Expenditure on social services (health, education and others) by Centre and States as a proportion of GDP increased from 6.2 % in 2014-15 to 8.6% in 2021-22 (BE).

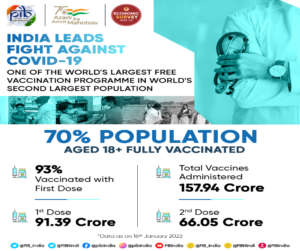

- 94 crore doses of COVID-19 vaccines administered as on 16th January 2022; 91.39 crore first dose and 66.05 crore second dose.

- As per the quarterly Periodic Labour Force Survey (PFLS) data up to March 2021, employment in urban sectors affected by pandemic has recovered almost to the pre-pandemic level.

- According to Employees Provident Fund Organization (EPFO) data, formalization of jobs continued during the second COVID wave and the adverse impact of COVID on formalization of jobs was much lower than during the first COVID wave.

- Increased allotment of funds to MNREGA to provide a buffer for unorganized labour in rural areas during the pandemic.

- Under Jal Jeevan Mission (JJM), 83 districts have become ‘Har Ghar Jal’ districts.

- As per the National Family Health Survey-5 (NFHS-5), Total Fertility Rate (TFR) came down to 2 in 2019-21 from 2.2 in 2015-16 and Infant Mortality Rate (IMR), under-five mortality rate and institutional births have improved in 2019-21 over 2015-16.

- Macroeconomic stability indicators suggest that the Indian Economy is well placed to take on the challenges of 2022-23. Combination of high foreign exchange reserves, sustained FDI and rising export earnings will provide an adequate buffer against possible global liquidity tapering in 2022-23. Economic impact of the “second wave” was much smaller than that during the full lockdown phase in 2020-21, though the health impact was more severe.

Key challenges and concerns for Indian economy-

- Inflation is the most important headwind as supply chain disruptions and slow economic growth have contributed to an increase in inflation.

- Stimulus spending in developed economies and pent up demand during the pandemic could lead to “imported inflation” in India.

- Key drivers of inflation include oils and fats as well as fuel prices driven up by high international prices of the commodities.

- The economic survey noted that major economies had begun the process of withdrawing liquidity that was extended during the pandemic in the form of stimulus checks and relaxed monetary policy to stimulate an economic recovery.

- The likely withdrawal of liquidity by major central banks over the next year may also make global capital flows more volatile.

- This may adversely affect capital flows, putting pressure on India’s exchange rate and slow economic growth.

- A lack of jobs is also one of the primary concerns for the Indian economy with unemployment levels and labour force participation rates remaining worse than pre-pandemic levels.

- According to data from the Periodic Labour Force Survey (PLFS), though the unemployment rate being 20.8 per cent in the first quarter of FY2021 fell to 9.3 per cent in Q4 of FY2021, it remained above the level 7.8 percent witnessed in Q2 of FY2020.

- The labour force participation rate at 47.5 percent in Q4 FY2021 was still below the level of 48.1 percent witnessed in Q4 FY2020.