The Economic Survey stated that India’s sovereign credit rating doesn’t reflect its fundamentals. The survey called for an overhaul of sovereign rating methodology, saying that the fifth-largest economy can’t be BBB- rated.

Dimensions:

- What are Sovereign Credit Ratings?

- Their Importance

- A trend of Ratings of India

- India’ s Complaints (Survey’s arguments)

- What should India do?

Content:

What are Sovereign Credit Ratings?

- A sovereign credit rating is an independent assessment of the creditworthiness of a country or sovereign entity.

- Sovereign credit ratings can give investors insights into the level of risk associated with investing in the debt of a particular country, including any political risk.

- At the request of the country, a credit rating agency will evaluate its economic and political environment to assign it a rating.

- Obtaining a good sovereign credit rating is usually essential for developing countries that want access to funding in international bond markets.

- Governments borrow huge funds by issuing debt instruments like government bonds. Creditworthiness here means the ability of the government to pay back its debt without default. Under sovereign credit rating, the factors considered are mainly the macroeconomic strength of the economy and the fiscal health of the government.

- Many countries seek ratings from the largest and most prominent credit rating agencies to encourage investor confidence.

- Standard & Poor’s, Moody’s, and Fitch Ratings are the three most influential agencies.

- Other well-known credit rating agencies include China Chengxin International Credit Rating Company, Dagong Global Credit Rating, DBRS, and Japan Credit Rating Agency (JCR).

Their Importance:

Effect on Bond and Stock Markets:

- changes in sovereign credit ratings significantly affect bond and stock markets.

- Average yield spreads increased two percentage points and average stock returns decreased one percentage point after downgrade of Sovereign Credit Ratings

- It is observed that rating changes had stronger effects during crises in both domestic and foreign financial markets

Spillover from Lower Rated to Higher Rated Countries:

- Researchers observed significant changes in government bond yields to changes in ratings and outlook, especially negative announcements.

- They found evidence of spillover of rating announcements from lower rated countries to higher rated countries.

Response of stock markets to rating announcements:

- Markets anticipate ratings downgrades and reviews for ratings downgrades.

- It is also found that sovereign rating changes to affect both, domestic as well as cross-country stock market returns.

Impact on FDI Flow:

- Donors’ as well as recipients’ credit ratings impact FDI flows.

- It’s observed that countries in high rated regions receive more FDI and that lower rated non-OECD and higher rated OECD recipients received more FDI.

- It was also found that post the 2008 global financial crisis, relative ratings affect private capital flows to emerging market economies.

Impact on Foreign Exchange Rates:

- Ratings affect own-country exchange rates as well as have strong regional spillover effect on exchange rates in the foreign exchange spot markets

A trend of Ratings of India:

- India witnessed one instance of credit rating downgrade from the investment grade to

- speculative grade during the period 1998-2018.

- This coincided with the period of international sanctions following the Pokhran nuclear tests in 1998.

- India witnessed three instances of credit ratings upgrade from the speculative grade to the investment grade. These were in the mid 2000s, as testament to India’s higher economic growth prospects and strong fundamentals.

- India’s sovereign credit rating downgrades during 1998-2018 are mainly confined to the 1990s on account of the post-Pokhran sanctions in 1998.

- India’s sovereign credit ratings upgrades have mainly been witnessed in the second half of 2000s, in recognition of higher economic growth prospects and strengthened fundamentals of the Indian economy.

- Further, during most of the 1990s and mid 2000s, India’s sovereign credit rating was

- speculative grade.

- Hence, during most of the decade of 1990 and early 2000’s, India’s high rate of economic growth co-existed with a sovereign credit rating of “speculative grade”.

- India’s credit rating was upgraded to investment grade by Moody’s in 2004, Fitch in 2006 and S&P in 2007 .

- Notably, Indian economy grew at an average rate of over six per cent, and at approximately eight per cent in several years during this period.

- Currently, India is rated investment grade by three major CRAs – S&P, Moody’s and Fitch.

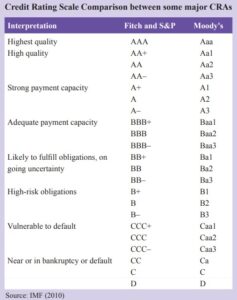

Grade of Credit Rating:

- Sovereign credit ratings broadly rate countries as either investment grade or speculative grade.

- The speculative grade is projected to have a higher likelihood of default on borrowings.

- The threshold of Investment grade is considered to be BBB- for S&P and Fitch and Baa3 for Moody’s.

India’s Complaints:

- The Economic Survey 2020-21 stated that India’s sovereign credit rating doesn’t reflect its fundamentals.

- The Survey questioned whether India’s sovereign credit ratings reflect its fundamentals, and found evidence of a systemic under-assessment of India’s fundamentals as reflected in its low ratings over a period of at least two decades.

- Never in the history of sovereign credit ratings has the 5th largest economy been rated as the lowest rung of investment-grade (BBB -).

- India is a clear outlier on several parameters, i.e. it is rated significantly lower than mandated by the effect on the sovereign rating of the parameter.

- These include GDP growth rate, inflation, general government debt (as per cent of GDP), cyclically adjusted primary balance (as per cent of potential GDP), current account balance (as per cent of GDP), political stability, rule of law, control of corruption, investor protection, ease of doing business, short-term external debt (as per cent of reserves), reserve adequacy ratio and sovereign default history.

- This outlier status remains true not only now but also during the last two decades

- India has consistently been rated below expectation as compared to its performance on various parameters during the period 2000-20.

- India’s willingness to pay is unquestionably demonstrated through its zero sovereign default history. Yet, within India’s sovereign credit ratings cohort, India is rated much below expectation for its number of sovereign defaults since 1990

- India’s ability to pay can be gauged not only by the extremely low foreign currency denominated debt of the sovereign but also by the comfortable size of its foreign exchange reserves that can pay for the short term debt of the private sector as well as the entire stock of India’s sovereign and non-sovereign external debt.

- As ratings do not capture India’s fundamentals, it comes as no surprise that past episodes of sovereign credit rating changes for India have not had a major adverse impact on select indicators such as Sensex return, foreign exchange rate and yield on government securities.

- The academic researches highlight bias and subjectivity in sovereign credit ratings, especially against countries with lower ratings

The Economic Survey Cited the following Researches for supporting its claims:

- Ferri, Liu, and Stiglitz (1999) suggested that CRAs aggravated the East Asian crisis by first failing to predict its emergence and thereafter becoming excessively conservative. CRAs downgraded East Asian crisis countries more than what would have been justified by these countries’ worsening economic fundamentals.

- Reinhart (2002) found evidence of procyclicality in ratings through her study of 62 economies over the period 1979-1999. She observed that sovereign credit ratings tend to be reactive, especially for emerging market economies, with significantly higher probability of downgrade as well as higher size of downgrade as compared to developed economies.

- Kaminsky and Schmukler (2002) also found evidence of procyclicality of credit ratings and that rating agencies may be contributing to financial market instability in emerging economies. They observed that rating upgrades take place after market rallies while downgrades take place after downturns

- Gültekin-Karakaş, Hisarciklilar and Öztürk (2010)studied the sovereign credit ratings of 93 countries from 1999-2010 and found evidence that CRAs give higher ratings to developed countries regardless of their macroeconomic fundamentals.

What should India do?

Follow Fearless Fiscal Policy:

- India’s fiscal policy must, therefore, not remain beholden to such a noisy/biased measure of India’s fundamentals

- India’s fiscal policy should be guided by considerations of growth and development rather than be restrained by biased and subjective sovereign credit ratings.

Larger engagements with Credit Rating Agencies for amending their methodology:

- While sovereign credit ratings do not reflect the Indian economy’s fundamentals, noisy, opaque and biased credit ratings damage FPI flows.

- Sovereign credit ratings methodology must be amended to reflect economies’ ability and willingness to pay their debt obligations by becoming more transparent and less subjective.

Rally Developing Economies to address bias:

- Developing economies must come together to address this bias and subjectivity inherent in sovereign credit ratings methodology to prevent exacerbation of crises in future.

Address negative impacts of pro-cyclical nature of credit ratings:

- The pro-cyclical nature of credit ratings and its potential adverse impact on economies, especially low-rated developing economies must be expeditiously addressed.

- India has already raised the issue of pro-cyclicality of credit ratings in G20. In response, the Financial Stability Board (FSB) is now focusing on assessing the pro-cyclicality of credit rating downgrades.

Mould your thought: What are Sovereign Credit Ratings? Discuss about the reasons for India’s sovereign credit rating not reflecting its fundamentals.

Approach to the answer:

- Introduction

- Define Sovereign Credit Ratings

- Discuss their importance in brief

- Write about the reasons for mismatch in India’s credit rating and its fundamentals

- Suggest solutions for these problems in brief

- Conclusion