In news- Recently, the Board of Governors of the IMF has approved a general allocation of Special Drawing Rights (SDRs) equivalent to US$650 billion to boost global liquidity.

Key updates

- It is a historic decision – the largest SDR allocation in the history of the IMF and a shot in the arm for the global economy at a time of unprecedented crisis.

- The general allocation of SDRs will become effective on August 23, 2021.

- The newly created SDRs will be credited to IMF member countries in proportion to their existing quotas in the Fund.

- Around US$275 billion (about SDR 193 billion) of the new allocation will go to emerging markets and developing countries, including low-income countries.

- The SDR allocation will benefit all members, address the long-term global need for reserves, build confidence, and foster the resilience and stability of the global economy.

- It will particularly help the most vulnerable countries struggling to cope with the impact of the COVID-19 crisis.

Impact on India

- With the approval of SDR allocation, India is likely to receive around $17.94 billion based on its existing 2.76% quota in the IMF.

- It would take the country’s total SDR to $19.48 billion.

- It would shoot up India’s forex reserves. India had SDRs worth $1.54 billion out of its total forex reserves of $619.4 billion as of 13 August.

Other initiatives of IMF

IMF’s Poverty Reduction and Growth Trust (PRGT)

Concessional support through the PRGT is currently interest free.

Funds for PRGT lending are obtained through bilateral loan agreements at market interest rates.

Subsidy resources make up the difference between the market rates received by lenders and the concessional rates paid by low-income countries (LICs) borrowers

The PRGT has these three concessional lending facilities:

- Extended Credit Facility (ECF): Sustained medium- to long-term engagement in case of protracted balance of payments problems

- Standby Credit Facility (SCF): Financing for LICs with actual or potential short-term balance of payments and adjustment needs caused by domestic or external shocks, or policy slippages—can also be used on a precautionary basis during times of increased risk and uncertainty

- Rapid Credit Facility (RCF): Rapid financial support as a single up-front payout for low-income countries facing urgent balance of payments needs—possible repeated disbursements over a (limited) period in case of recurring or ongoing balance of payments needs.

Resilience and Sustainability Trust

The IMF is working on this Trust which could help countries combat climate change or improve their health care systems.

What is the Special Drawing Right (SDR)?

- SDR is an interest-bearing international reserve asset created by the IMF in 1969 to supplement other reserve assets of member countries.

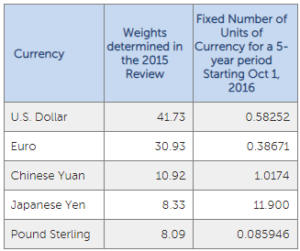

- The value of the SDR is based on a basket of five currencies—the U.S. dollar, the euro, the Chinese renminbi, the Japanese yen, and the British pound sterling.

- It is not a currency, nor a claim on the IMF, but is potentially a claim on freely usable currencies of IMF members.

- The value of the SDR is set daily by the IMF on the basis of fixed currency amounts of the currencies included in the SDR basket and the daily market exchange rates between the currencies included in the SDR basket.

- SDRs are only allocated to IMF members that elect to participate in the SDR Department. Currently all members of the IMF are members of the SDR Department.

- SDR is allocated to its members in the proportion of their quota.

- One SDR is currently valued at $1.416.

- SDRs can be held and used by member countries, the IMF, and certain designated official entities called “prescribed holders” but it cannot be held, for example, by private entities or individuals.

What is a general SDR allocation?

- An SDR allocation is a way of supplementing Fund member countries’ foreign exchange reserves, allowing members to reduce their reliance on more expensive domestic or external debt for building reserves.

The IMF has the authority under its Articles of Agreement to create unconditional liquidity through “general allocations” of SDRs to participants in its SDR Department in proportion to their quotas in the IMF.