In news – On the eve of completion of 4 years of the GST, CBIC honored the taxpayers contributing to the GST success story.

Key points-

- GST revenues have steadily grown and have been above the 1 lakh crore mark for eight consecutive months in a row.

- More than 88% of these taxpayers are from Micro (36%), Small (41%) and Medium enterprises (11%).

- Top five states in this regard are: Maharashtra, Karnataka, Tamil nadu, Haryana, West Bengal.

Significant steps taken under GST-

- The GST Council in its 37’th meeting held on 20th September, 2019 has approved the introduction of ‘E-invoicing’ or ‘electronic invoicing’.

- Quick Response Code (QR Code).

- Quarterly return Monthly Payment Scheme.

- Time limit for filing application for Revocation of Cancellation of Registration.

- The amendment relating to the E-Way Bill.

- Amnesty Scheme to provide relief to taxpayers regarding late fee for pending returns.

- Introduction of facility to withdraw the refund application.

About Goods & Services Tax(GST)-

- GST refers to the single unified tax created by amalgamating a large number of Central and State taxes presently applicable in India.

- It is a comprehensive, multi-stage, destination-based tax that is levied on every value addition.

- It was introduced on the 1st of July 2017.

- The genesis of the introduction of GST in the country was laid down in the historic Budget Speech of 28th February 2006, where the then Finance Minister laid down 1st April, 2010 as the date for the introduction of GST in the country.

- Thereafter, there has been a constant endeavor for the introduction of the GST in the country whose culmination has been the introduction of the Constitution (122nd Amendment) Bill in December, 2014.

- The 101st constitution Amendment Act of September 2016 made in this regard, inserted a definition of GST in Article 366 of the constitution by inserting a sub-clause 12A.

- GST subsumed 17 local levies like excise duty, service tax and VAT and 13 cesses.

- GST is proposed to be a dual levy where the Central Government will levy and collect Central GST (CGST) and the State will levy and collect State GST (SGST) on intra-state supply of goods or services.

- The Centre will also levy and collect Integrated GST (IGST) on inter-state supply of goods or services.

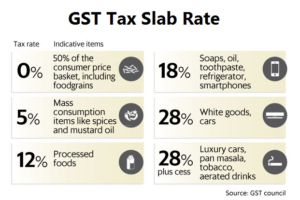

Goods and services are divided into five tax slabs for collection of tax – 0%, 5%, 12%, 18% and 28%. GST council- Structure, constitutional provisions-

GST council- Structure, constitutional provisions-

- As per Article 279A (1) of the amended Constitution, the GST Council has to be constituted by the President.

- As per Article 279A of the amended Constitution, the GST Council which will be a joint forum of the Centre and the States, shall consist of the following members:

- Union Finance Minister – Chairperson

- The Union Minister of State, in-charge of Revenue of finance – Member

- The Minister In-charge of finance or taxation or any other Minister nominated by each State Government – Members

- As per Article 279A(4), the Council will make recommendations to the Union and the States on important issues related to GST, like the goods and services that may be subjected or exempted from GST, model GST Laws, principles that govern Place of Supply, threshold limits, GST rates etc…