Manifest Pedagogy:

The GST has completed 5 years recently. One of India’s most significant indirect tax reforms was the drive toward “one nation, one tax.” The GST replaced 17 Union and State taxes as well as 13 cesses after over a decade of concerted efforts to reach a consensus. The GST council has acted as the fulcrum of this tax reform. It has been successful in achieving many of its stated goals, but there are still some significant issues that need to be resolved.

In News: The 47th meeting of the Goods and Services Tax Council was conducted in Chandigarh recently.

Placing it in Syllabus: Polity and Economy

Static Dimensions:

- About the GST Council

- Why was the GST Council set up?

- How the GST Council makes a Decision?

Current Dimensions:

- Supreme Court Ruling on GST

- Achievements of GST Council

- Challenges with GST Council

- GST council 47th meeting, its Outcomes

Content:

About the GST Council-

- The Goods and Services Tax regime came into force after the Constitutional (122nd Amendment) Bill was passed by both Houses of Parliament in 2016.

- More than 15 Indian states then ratified it in their state Assemblies, after which the President gave his assent.

- The GST Council is a joint forum of the Centre and the states and was set up by the President as per Article 279A (1) of the amended Constitution.

- The members of the Council include the Union Finance Minister (chairperson), the Union Minister of State (Finance) from the Centre.

- Each state can nominate a minister in-charge of finance or taxation or any other minister as a member.

- Secretariat is located in New Delhi and the Union Revenue Secretary acts as the ex-officio Secretary to the Council.

- The GST Council is considered as a constitutional federal body where both the Centre and the states get due representation.

Why was the GST Council set up?

- As per Article 279A (4), the Council will make recommendations to the Union and the States on important issues related to GST, like the goods and services that may be subjected or exempted from GST, model GST Laws, principles that govern Place of Supply, threshold limits, GST rates including the floor rates with bands, special rates for raising additional resources during natural calamities/disasters, special provisions for certain States, etc.

- It also decides on various rate slabs of GST. For instance, an interim report by a panel of ministers has suggested imposing 28 per cent GST on casinos, online gaming and horse racing.

How does the GST Council make a Decision?

The GST Council takes every decision at a meeting where a majority of not less than three-fourths of the votes of the members present and voting, as per the following conditions:

- While making a decision the Central Government of India has a weightage of one-third of the total votes cast.

- Also, the votes of the States Governments taken must have a weightage of two-thirds of the total votes cast.

- On the following grounds, any proceedings or act of the GST Council will not become invalid-

- Any deficit or vacancy in the constitution of the GST Council

- Any defect in the appointment of any member of the GST Council

- Any procedural irregularity of the GST Council does not affect the merits of the case

Supreme Court Ruling on GST

- The Supreme Court in a judgment championing the importance of “Cooperative federalism” for the well-being of democracy, held that Union and State legislatures have “equal, simultaneous and unique powers” to make laws on GST and the recommendations of the GST Council are not binding on them.

- The recommendations of the GST Council are the product of a collaborative dialogue involving the Union and the states.

- They are recommendatory in nature and to regard them as binding would disrupt fiscal federalism when both the Union and the states are conferred equal power to legislate on GST.

- The court emphasized that Article 246A of the Constitution treats the Union and the States as “equal units” and gives the States also the power to make laws with respect to GST.

- Article 279A (constituting the GST Council) envisions that neither the Centre nor the states are actually dependent on the other.

Achievements of GST Council-

- Has played a very crucial role in operationalising the GST regime in the country.

- Cooperative Federalism: The GST to be levied by the Centre is called Central GST (CGST) and that to be levied by the States is called State GST (SGST). CGST, SGST & Integrated GST (IGST) are levied at rates to be mutually agreed upon by the Centre and the States. The rates are notified on the recommendation of the GST Council. Since its inception, all but once decisions of the GST council have been through unanimous consensus. This shows an improvement in Co-operative Federalism in India.

- The GST council has met 47 times so far and have taken measures which made Rs 1 lakh crore GST collection per month ‘a new normal’. The collections had touched a record Rs 1.68 lakh crore in April 2022.

- Widening tax base: The number of registered taxpayers at the time when the GST was rolled out was 65 lakhs. Over the last five years, 1.3 crore taxpayers have been registered under the GST network, while 66 crore tax returns have been filed.

Challenges with GST council-

Reduction in the fiscal autonomy of the States– With the introduction of GST, many indirect taxes levied by the states have been replaced. GST rates are now decided by the GST Council which implies that states have limited flexibility in making decisions regarding tax rates on goods and services.

As per PRS Legislative Research report in 2018 transfers from the Centre are estimated to make 48 percent of states’ revenue. But with implementation of GST, the autonomy of states is expected to reduce an additional 17 per cent of their revenue. That is, the decision-making power of states will be limited to 35 per cent of their revenue.

Dispute Resolution-With a 1/3rd voting power, the Centre has a virtual veto over the decision making in the council (since 3/4th majority is needed to pass a decision). This has made the States question the functioning structure of the Council itself.

Resort to legal proceedings: In the absence of an alternate remedy, the only option left for states like Kerala and Punjab is to approach the Supreme Court under Article 131 of the Constitution. Such a judicial remedy to establish fiscal federalism of the states would erode even the limited institutional capital present between Centre and States.

Repeated changes in tax slabs of articles creates confusion. Unable to meet the target of compensation to states creates a distrust. Unlike many other economies which have implemented this tax regime, India has multiple tax rates.

GST council 47th meeting Outcomes-

- GST exemption has been withdrawn from ‘pre-packaged and labeled’ retail packs which will include food items such as curd, lassi, puffed rice, wheat flour, buttermilk, but items sold loose or unlabelled shall continue to remain exempt.

- The GST Council discussed recommendations of four ministerial panels — on rate rationalization, on movement of gold and precious stones, system reforms, and casinos, horse racing and online gaming.

- The Group of Ministers (GoM) on rate rationalization has been given a three-month extension to further work on tax slabs changes and rate rationalization.

- The GoM on system reforms has suggested extra measures for physical verification at the time of registration for high-risk taxpayers including biometric authentication, geo-tagging, use of electricity data and real-time monitoring of bank accounts.

- Mandatory generation of e-way bills by states for intra-state transportation of gold and precious stones with minimum threshold of Rs 2 lakh was also approved. These compliance measures and rate changes are expected to yield Rs 15,000 crore revenue in a year.

Impact of the decision-

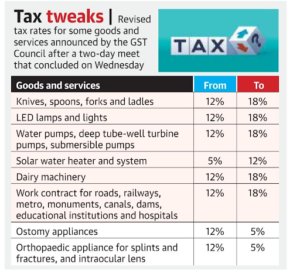

- Rate hikes for daily-use items such as LED lamps and packaged food items such as wheat flour, paneer, curd, lassi are expected to result in price hikes by companies and are expected to add to inflationary concerns.

- A tax rate of 12 per cent for hotels below the tariff of Rs 1,000/day is expected to affect the tourism segment in non-metro cities.

- The overall retail inflation rate based on Consumer Price Index, however, is unlikely to get affected sharply as the weightage of these items is low in the index.

Way Forward-

- A simpler tax slab structure limiting commodities to three tax slabs is the need of the hour. Experts have recommended a three-slab structure that will help rationalize this indirect tax system.

- The GST Council should adjust the rates only once a year to ensure tax predictability.

- Can consider bringing petroleum and electricity under GST ambit that will help prevent cascading and ensure further uniformity.

- Centre has to be more accommodative to State’s needs such as granting compensation amount without delays.

- The Centre shouldn’t bypass GST by introducing any cess.

- Ensuring no delays in GST refunds, plugging the existing loopholes and making GST more robust.

- An alternate dispute resolution mechanism to solve the disputes arising out of the decision of the GST council.

- Taking the states into confidence before any decision is taken.

Even if the GST administration has advanced quite well, there is still much work to be done before GST can fully realize its promise and become a genuine “One nation, One tax.”

Mould Your thoughts:

- “The GST regime has recently completed 5 years, in which the GST council has played a very crucial role”. In light of the statement, discuss the constitutional mandate behind the GST council and analyze its working. (250 Words)

Approach to the answer

- Constitutional provision of GST council

- Brief about recent council meet

- Positives of GST council working

- Issues with GST council

- Wayforward and Conclusion.