In news– International Energy Agency in its Energy Technology Perspectives 2023 report has said that most net-zero emission routes for steel and cement production are not yet commercially available despite a few companies in the automotive sector committing themselves to use ‘green steel’.

What is green steel?

Essentially, green steel is the manufacturing of steel without the use of fossil fuels.

So-called “green hydrogen” is one solution that could help reduce the steel industry’s carbon footprint.

Key highlights of the report-

- Solar and wind energy units require more steel, aluminium and in some cases, cement per unit of capacity than fossil fuel-based generating technologies.

- In order to manufacture technologies for renewable energy production, the steel and cement industry must target around 130 megatonnes (Mt) of primary steel and 370 Mt of cement production by 2030.

- Among certain project assessments that the researchers consider likely to achieve near-zero emission production immediately, they found only 10 per cent preparation towards a decarbonising effort for primary steel and 3 per cent for cement.

- These projects are mainly in Europe and North America, but demand grows most in emerging markets and developing economies, pointing to the need for increased international cooperation, the document observed on net-zero scenario projections.

- Key technologies such as carbon capture, utilisation and storage for cement and steel industries and hydrogen-based steel manufacturing are still in prototype and demonstration stages.

- Energy resources being concentrated in one geographical area pose a threat to the world’s energy security, as evidenced by Russia’s war on Ukraine.

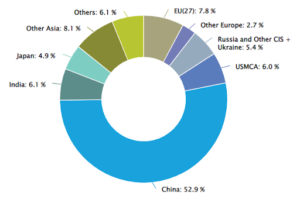

- Currently, China is the dominant producer of solar panels, wind, Electric Vehicle (EV) batteries, electrolysers and heat pumps.

- Lithium, a key metal for producing electronic vehicles, is mostly concentrated in Australia, Chile and China.

- Meanwhile, 70 per cent of the world’s cobalt is produced in the Republic of Congo.

- Tight supply chains increased the prices of EV batteries and wind turbines outside China for the first time in 2022.