Manifest Pedagogy:

The Ministry of Home Affairs (MHA) amended foreign funding rules giving certain relaxations such as allowing relatives to send more money under the Foreign Contribution Regulation Act (FCRA) and giving more time to the organizations to inform the government about opening of bank accounts for utilization of funds received under ‘registration’ or ‘prior permission’ category. These changes are a mixed bag, though it is with the noble objective to prevent usage of foreign funding against the interest of the nation, at the same time it can be misused by the government to curb any criticism or dissent.

In News: The Central government has made seven amendments to existing rules of the Foreign Contribution (Regulation) Act (FCRA) rules 2011 recently.

Placing it in the Syllabus: Polity and Governance

Static Dimensions:

- What is FCRA?

Current Dimensions:

- Changes in the FCRA rules

- Significance of these changes

- Foreign Contribution (Regulation) Amendment Bill, 2020

- Criticism of FCRA

Content:

What is FCRA?

- The Foreign Contribution (Regulation) Act (FCRA), 2010 consolidates the law to regulate the acceptance and utilization of foreign contribution or foreign hospitality by certain individuals or associations or companies.

- The FCRA regulates foreign donations and ensures that such contributions do not adversely affect internal security or are detrimental to the national interest.

- The Act extends across India and also applies to the citizens of India outside India.

- Associate branches or subsidiaries, outside India, of companies or bodies corporate, registered or incorporated in India also have to follow the rules of the Act.

- First enacted in 1976, it was amended in 2010 when a slew of new measures were adopted to regulate foreign donations.

- It is mandatory for all associations, groups and NGOs which intend to receive foreign donations to register themselves under the FCRA.

- The registration is initially valid for five years and it can be renewed subsequently if they comply with all norms.

- Registered associations can receive foreign contributions for social, educational, religious, economic and cultural purposes.

- Filing of annual returns, on the lines of Income Tax, is compulsory.

In 2015, the MHA notified new rules, which required NGOs to give an undertaking that the acceptance of foreign funds is not likely to prejudicially affect the sovereignty and integrity of India or impact friendly relations with any foreign state and does not disrupt communal harmony.

It also said all such NGOs would have to operate accounts in either nationalized or private banks which have core banking facilities to allow security agencies access on a real-time basis.

Members of the legislature and political parties, government officials, judges and media persons are prohibited from receiving any foreign contribution.

Note-

- The Home ministry had refused to renew the FCRA of a total 466 NGOs since 2020 for not fulfilling the eligibility criteria in accordance with the provisions of the law.

- There were 100 refusals in 2020, 341 in 2021 and 25 till March 2022.

- There are around 16,790 FCRA registered organizations in the country.

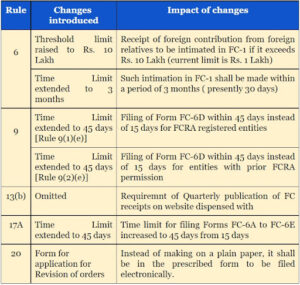

Changes in the FCRA rules-

- A provision where an organization/individual receiving foreign funds had to declare such contributions every quarter on its official website has been done away with.

- In the Foreign Contribution (Regulation) Rules, 2011, Rule 6 deals with intimation of receiving foreign funds from relatives.

- It stated earlier that “any person receiving foreign contribution in excess of one lakh rupees or equivalent thereto in a financial year from any of his relatives shall inform the Central government (details of funds) within 30 days from the receipt of such contribution”.

- The amended rule now allows relatives to send ₹10 lakhs without informing the government. If the amount exceeds, the individuals will now have three months to inform the government against 30-days earlier.

- Changes in Rule 9, which deals with application of obtaining ‘registration’ or ‘prior permission’ under the FCRA to receive funds

- The amended rules give individuals and organizations 45 days to inform the MHA about bank account (s) that are to be used for utilization of such funds. This time limit was 30-days earlier.

- The Centre has also ‘omitted’ provision ‘b’ in Rule 13, which dealt with declaring foreign funds including details of donors, amount received, and date of receipt etc every quarter on its website.

- Now, anyone receiving foreign funds under the FCRA will have to follow the existing provision of placing the audited statement of accounts on receipts and utilization of the foreign contribution for every financial year, within nine months of the closure of the financial year (March 31st), on its official website or on the website as specified by the Centre.

- In case of change of bank account, name, address, aims or key members of the organization (s) receiving foreign funds, the MHA has now allowed 45 days time to inform it, instead of the previous 15-day deadline.

- Made five more offenses under the FCRA “compoundable”, making in total 12, instead of directly prosecuting the organizations or individuals. Earlier, only seven offenses under the FCRA were compoundable.

Significance of these changes-

- It will make compliance with the rules easier as it provides more flexibility.

- It will ensure foreign funding is not used against the unity and security of the nation.

- It will result in a rise in the amount of money coming into India, stabilizing both the forex reserves and the rupee.

- It will reduce the amount of money leaving the country while boosting remittances coming in.

- The trade imbalance will be decreased by an increase in inflow of funds and a decrease in outflow of funds as a result of gold imports.

- It also intends to improve transparency and accountability in the receipt and use of foreign contributions, as well as to facilitate genuine NGOs working for the welfare of society.

Foreign Contribution (Regulation) Amendment Bill, 2020-

- The MHA had made the FCRA rules tougher in November 2020, making it clear that NGOs which may not be directly linked to a political party but engage in political action like bandhs, strike or road blockades will be considered of political nature if they participate in active politics or party politics.

- The organizations covered under this category include farmers’ organizations, students, workers’ organizations and caste-based organizations.

- The foreign contribution must be received exclusively in an account designated by the bank as an FCRA account in such State Bank of India, New Delhi branches.

- In the amended FCRA, the government barred public servants from receiving foreign funding and made Aadhaar mandatory for every office-bearer of NGOs.

- It says that organizations receiving foreign funds will not be able to use more than 20 percent of such funds for administrative purposes. This limit was 50 per cent before 2020.

- According to the law, all NGOs receiving funds have to be registered under the FCRA.

- The bill also makes the Aadhaar number mandatory for recipients (passport or OCI card will be used as the identification document in case of foreigners).

Criticism of FCRA-

- Lawyers have argued that there is no rational link between designating a particular branch of a bank with the objective of preserving national interest.

- It is difficult for NGO’s to operate as they have to open accounts in SBI Delhi.

- Government may use the law to curb genuine criticism by curbing freedom under Art 19- Freedom of expression, forming association.

- Impact the livelihood of workers dependent on these NGOs.

Way Forward-

- There has to be an objective and rational basis on which the government makes decisions regarding issuance of permits.It should uphold the fundamental rights under Art 19.

- There has to be a robust appeal mechanism against the government order as a corrective mechanism in case.

- All the data must be available in public domain, and organizations obtaining foreign funding must be encouraged to make all the disclosures public;y to ensure accountability..

- The flexibility provided in the recent changes in the rules must provide a thriving environment for genuine NGOs to work for the welfare of people and fill the gaps left in government functioning.

- It must be ensured that the changes do not provide any opportunity to law breakers to find the loopholes to bypass the law.

- There must be strict vigilance and implementation of the law.

Mould Your Thoughts:

Discuss the recent Amendments to rules of the Foreign Contribution Regulation Act. Evaluate how it will impact the foreing funding environment in the country. ( 250 words)

Approach to the answer-

- Brief about FCRA

- Write the amendments in the rules

- Significance of the changes

- Criticism of the changes

- Way Forward and conclusion