The relief package announced by the RBI in terms of Loan repayments was not so clear with respect to interest on interest and the broader impact on extension of EMIs for borrowers. The clarity with respect to interest on interest was much awaited by the government.

Current dimensions

- Issue of moratorium and SC petition

- Government stand

- Need for msme and personal loan restructuring

Content:

Issue of moratorium:

- On March 27, 2020, the RBI permitted all commercial banks (including regional rural banks, small finance banks and local area banks), co-operative banks, all-India Financial Institutions, and NBFCs to allow a moratorium of three months on payment of instalments in respect of all term loans outstanding as on March 1, 2020.

- This moratorium was later extended until August 31.

- This relief was provided to shield businesses from the economic impact caused by the COVID-19-induced lockdown.

- The liability was higher for recent loans and on the outstanding on credit cards.

- As per the RBI circular, interest would continue to accrue on the outstanding portion of the term loans during the three month moratorium which meant that a borrower would have to bear the burden of additional interest if he/she chose to avail the benefit.

SC petition:

- A petition was filed in the Supreme court seeking that no interest be charged during the moratorium as citizens were facing “extreme hardship”.

- It also sought directions to the government and the RBI to “appropriately consider extending the moratorium period for certain periods.

- The plea stated that the relief proclaimed to have been given by the respondents (Centre and RBI) was incomplete as it failed to provide interest relaxation to citizens and those who availed moratorium of three months would have to pay interest on the same subsequently.

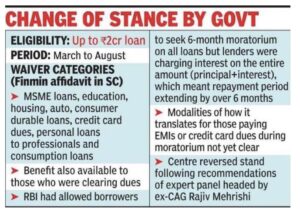

The Centre and the RBI had argued against any waiver of interest on interest on the grounds that it would be against the interests of other stakeholders, like depositors and would be unfair to those who had paid their dues. Now based on the recommendations of an expert committee headed by former CAG Rajiv Mehrishi, the centre has reversed its stance.

Government stand:

- The government submitted an affidavit to the SC and stated that it is willing to waive off compound interest for all borrowers with loans up to Rs 2 crore.

- The cost of the waiver would be borne by the government.

- The relief will be limited to only vulnerable categories of borrowers as waiving of interest on interest for all categories of borrowers would result in a very substantial and significant financial burden on several categories of banks, rendering most banks unviable.

- However it would be applicable to “all borrowers who meet the criteria irrespective of whether they availed of the moratorium or not”.

- Waiver categories include education, consumer durables, housing, credit card, auto, consumption, personal loans,and MSMEs.

- It has not distinguished between borrowers who have availed of the moratorium partially or fully.

- The government would bear the burden arising from such waiver of interest on interest, or compound interest, for the banks.

- It is estimated that the total cost of the waiver would be around Rs 6,000 crore.

The SC has asked the government and the RBI to file an additional affidavit within a week and the matter is to be heard next on October 13.

Likely impact on borrowers:

- The finance ministry will explore options such as cashbacks for individuals and MSMEs with debt up to Rs 2 crore and who repaid their dues on time.

- This ensures a level-playing field with those who availed the moratorium and could now be spared from being charged “interest on interest”.

- The interest on interest relief will be reflected in the reduced number of installments or slightly lower EMI for the same tenure.

Need for MSME and personal loan restructuring:

- The debt restructuring scheme for stressed micro, small and medium enterprises (MSMEs) is extended by three months in view of the distress caused by the Covid outbreak.

- According to the RBI’s Financial Stability Report (FSR) released in September, 65% of system loans to MSMEs were under moratorium as on April 30.

- This restructuring will have to be implemented by March 31, 2021.

The conditions stipulated by the RBI include:

- The aggregate exposure, including non-fund based facilities, of banks and NBFCs to the borrower does not exceed Rs 25 crore as on March 1, 2020.

- The borrower’s account was a ‘standard asset’ as on March 1, 2020.

- The restructuring of the borrower account is implemented by March 31, 2021.

- The borrowing entity is GST-registered on the date of implementation of the restructuring (will not apply to MSMEs that are exempt from GST-registration).

The move is expected to give additional relief to small enterprises, over and above the government guarantee-backed emergency credit scheme for them. The one-time restructuring of corporate and personal debt will help alleviate the stress faced by borrowers and ensure the soundness of the banking system.

- Elaborate the Centre’s recent decision to waive interest on interest during the loan moratorium period.

Approach to the answer:

- Write the issue on moratorium

- Write about government’s decision

- Conclude by stating the importance of the decision