The Indian economy is facing an unprecedented crisis, both of the pandemic and deteriorating economic strategic shifts because of land-border territorial disputes. Balancing the pandemic and also overcoming the challenge of making in India and take benefit of China plus one strategy is the need of the hour.

Static dimensions

- Why Slow Down before the pandemic?

Current dimensions

- Pandemic effect

- Atmanirbhar India

- China plus one strategy

- Compete with China

Content:

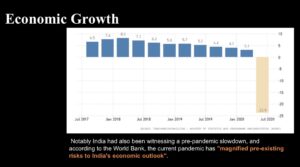

Why Slowdown before the Pandemic?

Consumption demand is the biggest driver of economic growth in India:

- In 2019-20, Private Final Consumption Expenditure (PFCE) had a share of 57% in India’s GDP.

- PFCE growth collapsed to 2.7% in the March 2020 quarter, the lowest since June 2012.

- Given the strengthening headwinds to consumption demand, firms started shelving investment plans.

- This can be seen in Gross Fixed Capital Formation (GFCF) contracting at an increasing rate for three consecutive quarters ending March 2020.

- A collapse in investment demand has adverse implications for the future growth potential of the economy.

- It was only government expenditure that was acting as a counter-cyclical force to some extent.

Fall in nominal growth was bigger:

- Nominal GDP growth in 2019-20 fell to just 7.2%, the lowest since 1975-76.

- The 2019-20 Union Budget assumed a 12% nominal growth.

- Nominal GDP is crucial for revenue collections, as taxes are a fraction of nominal incomes.

- The sharp fall in nominal growth was a big reason for a huge shortfall in tax collections in 2019-20.

- According to data from the Controller General of Accounts, which works under the ministry of finance, gross tax revenue collections were just 81.6% of the budget estimates in 2019-20, the lowest since 2000-01.

- The Corporate tax cut announced in September 2019 and the overall slowdown in the economy exacerbated matters on the revenue collection front and the fiscal deficit reached 4.6% of GDP.

Pandemic effect:

- Unemployment rose from 6.7% on 15 March to 26% on 19 April and then back down to pre-lockdown levels by mid-June.

- During the lockdown, an estimated 14 crore (140 million) people lost employment while salaries were cut for many others.

- More than 45% of households across the nation have reported an income drop as compared to the previous year.

- The Indian economy was expected to lose over ₹32,000 crores (US$4.5 billion) every day during the first 21-days of complete lockdown, which was declared following the coronavirus outbreak.

- Under complete lockdown, less than a quarter of India’s $2.8 trillion economic movements was functional.

- Up to 53% of businesses in the country were projected to be significantly affected.

- Supply chains have been put under stress with the lockdown restrictions in place.

- Those in the informal sectors and daily wage groups have been at the most risk.

- A large number of farmers around the country who grow perishables also faced uncertainty.

Atma Nirbhar India:

Prime Minister announced a 20 lakh crore stimulus package to jump-start the economy. The measures not only included relief measures for the troubled sectors but also outlined a new vision for emerging India.

Electronic Manufacturing:

1.National Policy on Electronics 2019 (NPE 2019):

- India as a global hub for Electronics System Design and Manufacturing (ESDM) by encouraging and driving capabilities in the country for developing core components, including chipsets, and creating an enabling environment for the industry to compete globally.

- An incentive of 25% on capital expenditure on plant, machinery, equipment, associated utilities, and technology, including for R&D to the industrial units making an investment for manufacturing of electronic components, semiconductors, ATMP, specialized sub-assemblies, and capital goods for these items, in the specified categories.

- This will cater to all segments of electronics manufacturing such as Mobile Electronics, Consumer Electronics, Industrial Electronics, Automotive Electronics, Medical Electronics, Strategic Electronics, Power Electronics, Telecom Equipment, Computer Hardware etc…

2. Modified Electronics Manufacturing Clusters (EMC 2.0) Scheme:

- It would support the setting up of both Electronics Manufacturing Clusters (EMCs) and Common Facility Centers (CFCs).

- An Electronics Manufacturing Cluster (EMC) would be set up in geographical areas of a certain minimum extent, preferably contiguous, where the focus is on the development of basic infrastructure, amenities, and other common facilities for the ESDM units.

- For Common Facility Centre (CFC), there should be a significant number of existing ESDM units located in the area and the focus is on upgrading common technical infrastructure and providing common facilities for the ESDM units in such EMCs, Industrial Areas/Parks/industrial corridors.

3. Production Incentive Scheme (PLI):

- The scheme proposes production linked incentives to boost domestic manufacturing and attract large investments in mobile phone manufacturing and specified electronic components including Assembly, Testing, Marking, and Packaging (ATMP) units.

- Extends an incentive of 4% to 6% on incremental sales (over a base year) of goods manufactured in India and covered under target segments, to eligible companies, for a period of 5 years subsequent to the base year as defined.

- The proposed scheme is likely to benefit 5-6 major global players and few domestic champions, in the field of mobile manufacturing and Specified Electronics Components and bring in large scale electronics manufacturing in India.

4. Medical Devices:

- Medical Device is a growing sector and its potential for growth is the highest among all sectors in the healthcare market.

- India depends on imports up to an extent of 85% of the total domestic demand of medical devices.

- The Medical Device sector suffers from a cost of manufacturing disability of around 12% to 15%, vis-a-vis competing economies, due to lack of adequate infrastructure, domestic supply chain and logistics, high cost of finance, inadequate availability of quality power, limited design capabilities and low focus on R&D and skill development etc…

- The new scheme aims to promote Medical Device Parks in the country in partnership with the States. A maximum grant-in-aid of Rs.100 crore per park will be provided to the States.

- An incentive @ 5% of incremental sales over the base year 2019-20 will be provided on the segments of medical devices identified.

5. Bulk Drugs:

- The decision is to develop 3 mega Bulk Drug parks in India in partnership with States.

- The government of India will give Grants-in-Aid to States with a maximum limit of Rs. 1000 Crore per Bulk Drug Park.

- Parks will have common facilities such as solvent recovery plant, distillation plant, power & steam units, common effluent treatment plant etc…

- A sum of Rs. 3,000 crore has been approved for this scheme for the next 5 years.

- A financial incentive will be given to eligible manufacturers of identified 53 critical bulk drugs on their incremental sales over the base year (2019-20) for a period of 6 years.

- Out of 53 identified bulk drugs, 26 are fermentation-based bulk drugs and 27 are chemical synthesis based bulk drugs.

- The rate of incentive will be 20 % (of incremental sales value) for fermentation-based bulk drugs and 10% for chemical synthesis based bulk drugs.

China Plus One strategy:

- China Plus One, also known simply as Plus One is the business strategy to avoid investing only in China and diversify the business into other countries.

- It has also been described as a ‘macro-level phenomenon’ and it may be done for reasons of cost, safety, or long-term stability.

- The advantages of the cheap labour and market demand that China initially provided has increasingly been overshadowed by the advantages that ASEAN countries can provide.

- The increasing cost of doing business in China has also increased operating costs, especially for manufacturers.

- Multinational corporations have been looking at countries with adequately stable governments such as Vietnam, Indonesia, Malaysia, Thailand, and the Philippines.

- Countries like Japan and the United States are part of the phenomenon, with the strategy conceptualizing in businesses in these countries as early as 2008.

- However, China Plus One strategy has its own share of difficulties, including navigating new laws, new markets, and streamlining the business over multiple locations. Some say that moving out of China now is not even practical.

- Following the COVID-19 pandemic, numerous Indian companies have adopted a strategy to find alternative supply chains.

- India’s largest air conditioner manufacturer has started production of motors in India to reduce its reliance on China;

- Indian auto component manufacturers are also building the base to shift out of China;

- Hanging reliance on local vendors for some components and the same is the case for pharma companies;

Compete with China:

- In a bid to increase industrial production capacity, Karnataka is developing manufacturing clusters in nine districts under the “Compete with China” scheme.

- Action is being taken to create one lakh jobs in each cluster.

- The scheme aims to have manufacturing-related activities taking place right from the village level to the taluk (sub-district) and district levels of each cluster.

Mould your thought:

- What is China Plus One strategy? What are the initiatives taken by the government to promote electronics manufacturing in India?