Manifest Pedagogy:

The country is facing high inflation in present times.Food and beverage items have a combined 45.86% weight in the overall CPI which is one of the most important reasons for high inflation. The RBI is supposed to be accountable, but it can’t win the inflation battle without the government.Wanting to be left alone is one thing. But this is a battle the central bank cannot win without the government.An effective balancing of fiscal and monetary policy by the government is the most prudent way to tackle the growing inflationary pressure on the Indian Economy that would help in keeping the inflation level in the ideal range of 2-4%.

In News:Retail inflation rose to 7 per cent in August, marking the eight consecutive month above the upper threshold of the Reserve Bank of India’s target of 4 +/- 2 per cent.

Placing it in the Syllabus: Economy

Static Dimensions

- Background

- Facts

Current Dimensions

- Main causes of inflation

- Failure of accountability of RBI

- Reason for this situation

- Monetary dependence

- Implications of these measures

Content

Background

- May 2016, India adopted inflation targeting as a policy goal enshrined in law, it also embraced the idea of central bank “independence with accountability”.

- Under the new statutory framework, the central government would, in consultation with the Reserve Bank of India (RBI), set an inflation target based on the consumer price index (CPI) once every five years.

- The RBI was entrusted with the responsibility of meeting this target (“accountability”), for which it would be given “independence” in the conduct of monetary policy.

- But in the situation that the economy today is in, the RBI is struggling to be accountable and, at the same time, having to increasingly depend on the government for fulfilling its mandate.

Facts

- Inflation in rural areas stood at 7.15 per cent in August, higher than the inflation in urban areas at 6.72 per cent, with food inflation at 7.6 percent and 7.55 per cent, respectively.

- Cereals inflation rose to 9.57 per cent in August from 6.90 percent last month, while vegetables inflation increased to 13.23 percent from 10.90 percent.

- Spices also recorded a double-digit inflation at 14.90 percent in August, up from 12.89 percent last month.

Main causes of inflation

- Russia Ukraine Conflict: The ongoing conflict has created shortages of various commodities like wheat, oil and gas etc.

- The shortage has been created by disruption of supply chains due to the war hitting the exports from these 2 nations.

- Further, the series of sanctions imposed by the west on Russia has further enhanced the global prices of commodities.

- Pandemic: In 2020-21, when the pandemic hit the economy, food prices rose by an even larger factor (7.3%) and the core inflation rose by 5.5%.

- The Supply chains were disrupted due to the lockdowns. The demand has recovered but the supply has not been restored causing a rise in prices.

- Monetary Policy: According to Dr. C Rangarajan (former RBI Governor), the loose monetary policy after the pandemic has led to excess liquidity in the economy, which has resulted in higher inflation.

- Post Election policies: An eventual pass-through of the higher crude oil prices to domestic consumers started happening in late March after elections to five Assemblies were completed.

Failure of accountability of RBI

- The Centre, under section 45ZA of the RBI Act, 1934, has fixed the CPI inflation target at 4% with an “upper tolerance limit” of 6%.

- Actual year-on-year inflation in 2022 has ruled above 6% every single month from January to August.

- If it does so in September as well, the RBI, under section 45ZN of the same law, will have to submit a report to the Centre on “the reasons for failure to achieve the inflation target” and “remedial actions proposed to be taken by the Bank”.

- In this case, “failure” is defined as inflation being more than the upper tolerance level of the target “for any three consecutive quarters”.

- Accountability has been a relatively new problem though.

- Roughly from April 2014 to March 2019 , CPI inflation was above 6% only in 6 out of 60 months.

- Moreover, 5 of those 6 months were in 2014, well before the RBI Act was amended to provide a statutory basis for inflation targeting.

- In the 41 months from April 2019, inflation has exceeded 6% in as many as 21.

- In other words, a failure rate of over 50%, as against 10% during the 1st tenure of the present government.

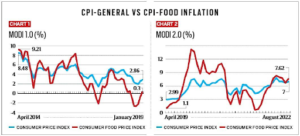

- Also, average CPI inflation was 4.5% during Modi 1.0, whereas it has been 5.7% so far in Modi 2.0.

Reason for this situation

- There’s a simple reason for the RBI’s “failure” to adhere to its inflation-targeting mandate.

- It has to do with food and beverage items, which have a combined 45.86% weight in the overall CPI.

- The accompanying charts show year-on-year increases in the general CPI as well as the consumer food price index (CFPI), both during Modi 1.0 and Modi 2.0.

- During 2014-2019 food inflation was lower than general inflation in 38 out of the 60 months, with the former averaging just 3.5%.

- Thus, while inflation overall was benign (average of 4.5%), food inflation was even more so.

- It has been quite the other way round since 2019, with average CFPI inflation, at 6.3%, more than the 5.7% for general inflation.

- Also, food inflation has been lower than CPI inflation in only 21 out of 41 months. While CPI inflation has risen and overshot the 6% target, especially in recent months, the acceleration has been all the more for food inflation since late-2021.

- The latter has also tended to exhibit greater volatility during Modi 2.0, which is clear from the charts.

- Simply put, both the “success” of inflation targeting in Modi 1.0 and “failure” in Modi 2.0 has been largely courtesy of food prices.

Monetary dependence

- The second issue of monetary policy independence which basically refers to the central bank being insulated from government interference or electoral pressure in setting its interest rates with a view to achieving low and stable inflation

- The preponderant weight of food items in the Indian consumption basket and hence its CPI in contrast to developed countries where their shares are hardly 10-25% —makes inflation that much less amenable to control through repo interest rate or cash reserve ratio hikes.

- The RBI, then, is forced to rely more on government action to meet inflation targets. Far from acting independently — using monetary policy tools that seek to curb demand by raising borrowing costs for firms and consumers — it has to depend on “supply-side” measures by the government.

- That translates into monetary dependence, not independence.

- In the last one year, the effective import duty on crude and refined palm oil has come down from 30.25% and 41.25% to 5.5% and 13.75%, respectively. It’s been even sharper — from 30.25% to nil — for crude soybean and sunflower oil.

- On May 13, this year, the government banned exports of wheat. This was extended to wheat flour — including atta, maida and rava/ sooji (semolina).

- On September 8, exports of broken rice were prohibited.

- Besides, a 20% duty was imposed on shipments of all other non-parboiled non-basmati rice.

- On May 24, sugar exports were moved from the “free” to “restricted” category. Further, total exports for the 2021-22 sugar year (October-September) were capped at 10 million tonnes, which was raised to 11.2 million tonnes on August 1.

- The export quota for the next sugar year is yet to be announced.

- On August 12, the Centre directed states and union territories to force pulses traders/millers to declare their stocks of tur (pigeon-pea) and upload this information on a weekly basis.

Implications of these measures

- The framework of inflation targeting and central bank “independence with accountability” worked well during 2014-2019. That period was characterised by benign food (and fuel) prices, both domestic and globally.

- The RBI could, therefore, act in almost splendid isolation and pursue its goal of price stability without being constrained by government intervention or even fiscal policy.

- Things have been different since then. The last two years or less have seen a resurgence of inflation, driven mainly by supply-side factors from the pandemic and the war in Ukraine to extreme weather events.

- The last includes excess rain during September-January 2021-22, the heat wave in March-April and the deficient monsoon in the Gangetic plain states this time.

- These along with skyrocketing prices of fuel, which have a 6.84% weight in the CPI, over and above the 45.86% of food have rendered the RBI’s demand-side toolkit to fight inflation ineffective.

Effects of rise in the inflation rate

- Inflation could lead to economic growth as it can be a sign of rising demand.

- Inflation could further lead to an increase in costs due to workers’ demand to increase wages to meet inflation. This might increase unemployment as companies will have to lay off workers to keep up with the costs.

- Domestic products might become less competitive if inflation within the country is higher.

- It can weaken the currency of the country.

- The poor are the worst affected because they have little buffer to sustain through long periods of high inflation.

Wayforward

- Long-term investments: spending money now for investments can allow you to benefit from inflation in the future.

- Policies to increase the efficiency and competitiveness of the economy helps in reducing the long term costs.

- Controlling the money supply can also help in preventing inflation.

- Higher Income Tax rates can reduce spending, hence resulting in lesser demand and inflationary pressures.

- The government can also enter into special agreements to combat inflationary pressures. For instance, India secured Russian crude oil in the face of sanctions, reportedly on offer at a discount of $20-30 per barrel.

- Structural changes– Modernising agriculture, robust market mechanism, cold storage infrastructure, more emphasis on food processing, enhancing irrigation potential, from fork to farm( demand based production).

Mould your thoughts

- RBI teeters on the edge of failure as retail inflation scales back 7% level. Analyse the factors responsible for it. Also suggest steps to be taken by the government and RBI to control inflation. (250 words)

Approach to the answer

- Introduction about present situation

- RBI’s mandate

- Causes of inflation and why RBI failed

- Implications of this.

- Steps to be taken by the government and RBI.

- Wayforward and Conclusion.