In news– The Reserve Bank of India(RBI) has recently announced its decision to allow trade settlements between India and other countries in rupees.

Key guidelines of RBI-

- According to RBI, all exports and imports under this arrangement may be denominated and invoiced in rupee (INR) and the exchange rate between the currencies of the two trading partner countries may be market determined.

- Before putting in place this mechanism, banks will be required to take prior approval from the Foreign Exchange Department of Reserve Bank of India, Central Office at Mumbai.

- It has also said that AD (authorised dealer) banks in India have been permitted to open rupee Vostro accounts.

- Accordingly, for settlement of trade transactions with any country, AD bank in India may open special rupee vostro accounts of correspondent banks of the partner trading country.

- Note: Vostro account is an account that a correspondent bank holds on behalf of another bank — for example HSBC vostro account is held by SBI in India.

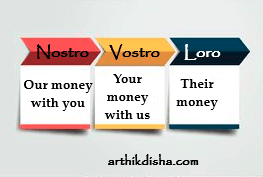

- To facilitate ease of doing international trades & businesses banks generally maintain three types of current accounts for the quick transfer of funds in different currencies namely ‘Nostro’, ‘Vostro’ and ‘Loro’.

- Indian importers undertaking imports via this mechanism will make payment in INR which will be credited into the Special Vostro account of the correspondent bank of the partner country, against the invoices for the supply of goods or services from the overseas seller.

- Indian exporters using the mechanism will be paid the export proceeds in INR from the balances in the designated Special Vostro account of the correspondent bank of the partner country.

- As per the notification, Indian exporters may receive advance payment against exports from overseas importers in Indian rupees through the above Rupee Payment Mechanism.

- Before allowing any such receipt of advance payment against exports, Indian banks need to ensure that available funds in these accounts are first used towards payment obligations arising out of already executed export orders / export payments in the pipeline.

- The RBI mechanism is expected to facilitate importers and exporters to avoid rules that prevent the use of a global currency such as the US dollar for trade with certain countries.

How does it work?

- To settle trade transactions with any country, banks in India will open Vostro accounts of correspondent bank/s of the partner country for trading.

- Indian importers can pay for their imports in rupee into these accounts. These earnings (from imports) can then be used to pay Indian exporters in Indian rupee.

How does the current system payment work?

- As of today, if a company exports or imports, transactions are always in a foreign currency (excluding with countries like Nepal and Bhutan).

- So in case of imports, the Indian company has to pay in a foreign currency (mainly dollars and could also include currencies like pounds, Euro, yen etc.).

- The Indian company gets paid in foreign currency in case of exports and the company converts that foreign currency to rupee since it needs rupee for its needs, in most of the cases.

Which countries will com under this new model?

- While the RBI order has not overtly said so, this arrangement is likely to be used only for Russia.

- There are sanctions on Russia post the Ukraine war and the country is off the SWIFT system (system used by banks for payments in foreign currency).

- This means payments do not have to be made in foreign currency and this arrangement would help both Russia and India.

- However, it is highly unlikely that it will be extended to other countries.

- India currently allows payment in rupees to countries like Nepal and Bhutan.

- Sri Lanka may also want us to pay in dollars or any other foreign currency.

Its impact-

- While the move is seen to benefit trading primarily with Russia, it is also likely to help check dollar outflow and slow rupee depreciation to a ‘very limited extent’.

- The move would also reduce the risk of forex fluctuation specially looking at the Euro-Rupee parity.