In news-In a recent report, State Bank of India has stated that the stage is set for a reverse repo normalization.

What is monetary policy normalization in India?

- The Reserve Bank of India, keeps tweaking the total amount of money in the economy to ensure smooth functioning.

- As such, when the RBI wants to boost economic activity it adopts a so-called “loose monetary policy”.

- There are two parts to such a policy i.e., injecting more money (liquidity) into the economy and RBI also lowers the interest rate it charges banks when it lends money to them; this rate is called the repo rate.

- The reverse of a loose monetary policy is a “tight monetary policy” and it involves the RBI raising interest rates and sucking liquidity out of the economy by selling bonds (and taking money out of the system).

- When any central bank finds that a loose monetary policy has started becoming counterproductive (for example, when it leads to a higher inflation rate), the central bank “normalizes the policy” by tightening the monetary policy stance.

- Under normal circumstances, that is when the economy is growing at a healthy pace, the repo rate becomes the benchmark interest rate in the economy.

- However, the reverse repo had become the benchmark rate in India since the start of the Covid pandemic.

What is reverse repo normalization?

- Reverse repo normalization means the reverse repo rates will go up.

- Over the past few months, in the face of rising inflation, several central banks across the world have either increased interest rates or signaled that they would do so soon.

- In India, too, it is expected that the RBI will raise the repo rate. But before that, it is expected that the RBI will raise the reverse repo rate and reduce the gap between the two rates.

- This process of normalization, which is aimed at curbing inflation, will not only reduce excess liquidity but also result in higher interest rates across the board in the Indian economy — thus reducing the demand for money among consumers (since it would make more sense to just keep the money in the bank) and making it costlier for businesses to borrow fresh loans.

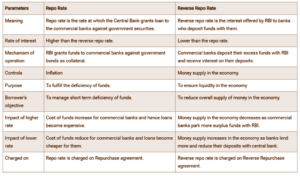

Repo vs Reverse repo rate-

Repo rate is the rate at which the Central Bank grants loans to the commercial banks against government securities. Reverse repo rate is the interest offered by RBI to banks who deposit funds with them.