The government recently unveiled a four-year National Monetisation Pipeline (NMP) worth an estimated Rs 6 lakh crore. It aims to unlock value in brownfield projects by engaging the private sector, transferring to them revenue rights and not ownership in the projects, and using the funds generated for infrastructure creation across the country. So, aspirants can expect questions on it in the Mains exam.

Dimensions:

- Brief on National Monetisation Pipeline

- What is Monetisation and how is it different from divestment?

- Advantages of Monetisation

- Challenges in Monetisation

- Roadmap of NMP (framework)

Content:

Brief on National Monetisation Pipeline:

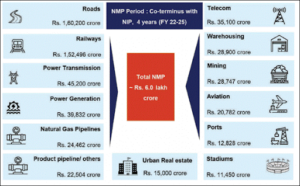

- The National Monetisation Pipeline (NMP) comprises a four-year pipeline from 2022-2025 of the central government’s brownfield infrastructure assets

- NMP is an alternative to an outright sale of assets. The ownership of the assets monetized, though, will remain with the government, with the private players taking on the operational risk.

- The idea is to lease out brownfield projects and use the proceeds from it to finance greenfield (New) projects.

- Roads, railways and power sector assets will comprise over 66% of the total estimated value of the assets to be monetised.

- Besides these, assets such as mining, aviation, roads, shipping, telecom, power transmission lines, warehousing, sport facilities, realty & hotel assets and gas pipelines will also be part of the monetisation plan.

- The ownership (of assets) will remain with the government and there will be a mandatory hand back after a certain time. The government is not selling off anything

- Only under-utilised assets will be monetised and the plan will help identify brownfield assets that need to be better monetised

- Monetisation through disinvestment and monetisation of non-core assets have not been included in the NMP.

- For the FY22, the government through its asset monetization program plans to raise ₹88,000 crores.

- An empowered committee has been constituted to implement and monitor the Asset Monetization program. The Core Group of Secretaries on Asset Monetization (CGAM) will be headed by the Cabinet Secretary.

Cooperative Federalism / Incentivizing states to participate:

- The central government is also incentivizing states to participate in this program.

- The Central government has already set aside Rs 5,000 crore as incentives.

- If a state government divests its stake in a PSU, the Centre will provide a 100 percent matching value of the divestment to the state.

- If a state lists a public sector undertaking in the stock markets, the Central government will give it 50 percent of that amount raised through listing.

- If a state monetises an asset, it will receive 33 of the amount raised from monetisation from the Centre.

What is Monetisation and How is it different from divestment?

- Asset monetisation, also commonly referred to as asset or capital recycling, is globally a widely used business practice.

- Asset Monetisation entails a limited period license/ lease of an asset, owned by the government or a public authority, to a private sector entity for an upfront or periodic consideration.

- This consists of limited period transfer of performing assets (or disposing of non-strategic / underperforming assets) to unlock “idle” capital and reinvesting it in other assets or projects that deliver improved or additional benefits.

- Governments and public-sector organizations, which own and operate such assets and are primarily responsible for delivering infrastructure services, can adopt this concept to meet the ever-increasing needs of the population for improved quality of public assets and service.

- In a monetisation transaction, the government is basically transferring revenue rights to private parties for a specified transaction period in return for upfront money, a revenue share, and commitment of investments in the assets.

- Therefore, there is no change in ownership. However, private players will be taking on the operational risk.

- Monetisation is similar to giving assets on a lease.

- Real estate investment trusts (REITs) and infrastructure investment trusts (InvITs), for instance, are the key structures used to monetise assets in the roads and power sectors.

- These are also listed on stock exchanges, providing investors liquidity through secondary markets as well.

- While these are a structured financing vehicle, other monetisation models on PPP (Public Private Partnership) basis include:

- Operate Maintain Transfer (OMT),

- Toll Operate Transfer (TOT), and

- Operations, Maintenance & Development (OMD).

- OMT and TOT have been used in the highways sector while OMD is being deployed in case of airports.

On the other hand:

- Disinvestment is just the opposite of investment, i.e. it means pulling out the money invested in the company by selling the stake, either partially or fully.

- Disinvestment involves dilution of ownership of the business / PSU.

- In disinvestment, usually, 26% or 51% of share is retained with the government company, and the rest is transferred to the strategic partner.

Advantages of Monetisation:

Financing Future Asset Creation:

- With a massive infrastructure deficit, finding resources to build physical assets is a difficult task.

- These projects require heavy investment. Monetising underutilised assets gives the government the capital required for such projects.

- Hence, the government wants to monetize existing infrastructure assets by leasing them out to private firms for a fixed tenure under a revenue-sharing model.

Fiscal Prudence:

- It will help the authorities ease fiscal constraints and free up balance sheets for more greenfield infrastructure creation.

- For example, a stadium, built by the government that remains idle for the most part of the year, can be leased to a private party that can efficiently manage it by organizing cultural functions and allowing the public to use it for a fee.

Raising Resource-use Efficiency:

- It leads to optimum utilisation of government assets.

- The end objective of NMP is to enable ‘Infrastructure Creation through Monetisation’ wherein the public and private sector collaborate, each excelling in their core areas of competence, so as to deliver socio-economic growth and quality of life to the country’s citizens.

Revival of the economy and create sustainable demand:

- It could also provide State governments with the additional resources needed to sustain public investment during this period of stressed public finances.

- By monetising the existing asset base, their proceeds could be used for new infrastructure creation, recycling the future assets and build multiplier effect on growth and revive credit flow

Mobilising Private Capital:

- Since the assets are de-risked as brownfield projects, it will help in mobilising private capital (both domestic & foreign).

- Global investors have revealed that they are keen to participate in projects to be monetised through a transparent/competitive bidding process.

Less Political Resistance:

- The plan involves leasing to the private sector without transferring ownership or resorting to fire sale of assets. Therefore, it is expected to face less resistance from the opposition.

Challenges in Monetisation:

Among the key challenges that may affect the NMP roadmap are:

- Lack of identifiable revenue streams in various assets

- Inadequate level of capacity utilisation in gas and petroleum pipeline networks

- Lack of dispute resolution mechanism.

- Regulated tariffs in power sector assets

- Low interest shown by investors in national highways below four lanes

- Lack of independent sectoral regulators

- In the current atmosphere of strained Centre-state relations, fructification of such plans would require deft political management.

Roadmap of NMP:

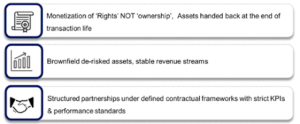

The framework for monetisation of core asset monetisation has 3 key imperatives:

- Monetisation of rights not ownership which means the assets will have to be handed back at the end of transaction life. The overall transaction will be structured around revenue rights.

- Brownfield de-risked assets: There is no land here, this entire (NMP) is about brownfield projects where investments have already been made and there is a completed asset which is either languishing or it is not fully monetised or is under-utilised.

- Structured partnerships under defined contractual frameworks & transparent competitive bidding, where Contractual partners will have to adhere to Key Performance Indicators and Performance Standards.

Mould your thought: How is Asset Monetisation different from disinvestment? Critically evaluate the provisions of the National Monetisation Pipeline.

Approach to the answer:

- Introduction

- Define both Asset monetisation and disinvestment.

- Wirie the differences between them

- Mention the major provisions of NMP

- Mention the advantage of NMP briefly

- Discuss the challenges to NMP

- Conclusion