In news

Recently, the World Bank has approved a $500 million loan programme to support India’s informal working class hit by the Covid-19 pandemic.

Key updates

- The loan of $500 million(about Rs 3,717.28 crore) will create greater flexibility for states to cope with the ongoing pandemic, future climate and disaster shocks.

- Of the USD 500 million commitment, USD 112.50 million is financed by its concessionary lending arm International Development Association and USD 387.50 million is a loan from International Bank for Reconstruction and Development (IBRD).

- The loan has a maturity period of 18.5 years including a grace period of five years.

Objective of social funding

Amidst pandemic & economic slowdown, investment in social protection is aimed at building the resilience of economies and livelihoods of communities. This is the broader objective of the social protection programmes supported by the World Bank in India

Extent of its funding since the start of pandemic

- According to the World Bank, its total funding towards strengthening India’s social protection programmes to help the poor and vulnerable households since the start of the pandemic stands at USD 1.65 billion (about Rs 12,264.54 crore).

- It said that the first two operations approved last year provided immediate emergency relief cash transfers to about 320 million individual bank accounts identified through pre-existing national social protection schemes and additional food rations for about 80 crore individuals.

Utilization of the fund

- States can now access flexible funding from disaster response funds to design and implement appropriate social protection responses.

- The funds will be utilised in social protection programmes for urban informal workers, gig-workers, and migrants.

How does it help the informal sector in India?

- A National Digital Urban Mission will create a shared digital infrastructure for people living in urban areas through investments at the municipal level to help scale up urban safety nets and social insurance for informal workers.

- It will also include gender-disaggregated information on women workers and female-headed households.

- This will allow policymakers to address gender-based service delivery gaps and effectively reach the unreached, particularly widows, adolescent girls, and tribal women.

- The programme will give street vendors access to affordable working capital loans of up to Rs 10,000.

- Urban Local Bodies (ULBs) will identify them through an IT-based platform.

- Some five million urban street vendors could benefit from the new credit programme.

Significance

The operation will enhance the capability of states to use resources based on an assessment of local risks and expand the social protection net for underserved urban informal workers while laying the groundwork for a more climate-responsive social protection system.

Informal sector in India

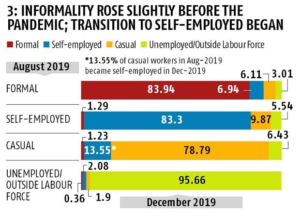

- India has one of the highest numbers of informal workers in the world, estimated to be between 75 to 90% of all workers.

- Informal workers are facing substantial economic losses due to the pandemic and subsequent lockdowns.

About World Bank

- The World Bank Group is one of the world’s largest sources of funding and knowledge for developing countries.

- Founded in 1944, the International Bank for Reconstruction and Development—soon called the World Bank—has expanded to a closely associated group of five development institutions.

- Originally, its loans helped rebuild countries devastated by World War II.

- Its five institutions share a commitment to reducing poverty, increasing shared prosperity, and promoting sustainable development.

- Mission:

- To end extreme poverty:By reducing the share of the global population that lives in extreme poverty to 3 percent by 2030.

- To promote shared prosperity:By increasing the incomes of the poorest 40 percent of people in every country.

- The World Bank is like a cooperative, made up of 189 member countries.

- These member countries, or shareholders, are represented by a Board of Governors, who are the ultimate policymakers at the World Bank.

- Generally, the governors are member countries’ ministers of finance or ministers of development.

- The World Bank Group is a unique global partnership which consists of five development institutions.

World Bank Group

- International Bank for Reconstruction and Development (IBRD) provides loans, credits, and grants.

- International Development Association (IDA) provides low- or no-interest loans to low-income countries.

- The International Finance Corporation (IFC) provides investment, advice, and asset management to companies and governments.

- The Multilateral Guarantee Agency (MIGA) insures lenders and investors against political risk such as war.

The International Centre for the Settlement of Investment Disputes (ICSID) settles investment-disputes between investors and countries. India is not a member of ICSID.