In News: The Customs (Administration of Rules of Origin under Trade Agreements) Rules, 2020 (CAROTAR, 2020) shall come into force from September 21.

Stricter Rules:

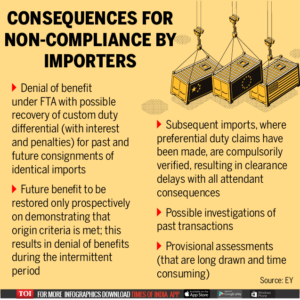

Importers will have to ensure that imported goods meet the prescribed ‘rules of origin’ provisions for availing concessional rate of customs duty under Free Trade Agreements (FTAs).

- Importers have to prove that imported products have undergone value addition of at least 35% in the countries of origin.

- Earlier, merely a country of origin certificate, issued by a notified agency in the country of export was sufficient to avail the benefits of FTAs.

- This was exploited in many cases, i.e. the FTA partner countries have been claiming to have produced the goods in question without having the necessary technological capacity for the required value addition.

Reason for Stricter Rule:

- The investigation into FTA imports in the last few years has revealed that the rules of origin, under respective FTAs, were not being followed in the true spirit.

- Customs officials suspect that China diverts its supplies to India through Association of Southeast Asian Nations (ASEAN) nations, abusing rules of origin, to illegally take advantage of duty-free market access under FTA

- Major imports to India come from five ASEAN countries — Indonesia, Malaysia, Thailand, Singapore and Vietnam.

- The ASEAN FTA allows imports of most items at zero or concessional basic customs duty from the 10-nation bloc.

- Given the latest border standoff between India and China, the diversion may surge.

Why need CAROTAR?

- CAROTAR 2020 supplements the existing operational certification procedures prescribed under different trade agreements.

- India has inked FTAs with several countries, including Japan, South Korea and ASEAN members.

- Under such agreements, two trading partners significantly reduce or eliminate import/customs duties on the maximum number of goods traded between them.

- The new rules will assist customs authorities in the smooth clearance of legitimate imports under FTAs.

Its significance

- The ASEAN FTA allows imports of most items at nil or concessional basic customs duty from the 10-nation bloc.

- Major imports to India come from five ASEAN countries — Indonesia, Malaysia, Thailand, Singapore and Vietnam.

- The benefit of concessional customs duty rate applies only if an ASEAN member country is the country of origin of goods.

- This means that goods originating from China and routed through these countries will not be eligible for customs duty concessions under the ASEAN FTA

Free Trade Agreement

- It is an arrangement between two or more countries or trading blocs that primarily agree to reduce or eliminate customs tariff and non tariff barriers on substantial trade between them.

- It covers trade in goods (such as agricultural or industrial products) or trade in services (such as banking, construction, trading etc.).

- It also covers other areas such as intellectual property rights (IPRs), investment, government procurement and competition policy etc.

- India has inked FTAs with several countries, including Japan, South Korea, Sri Lanka and ASEAN members.

- Benefit:

- By eliminating tariffs and some non-tariff barriers, FTA partners get easier market access into one another’s countries.

- Exporters prefer FTAs to multilateral trade liberalization because they get preferential treatment over non-FTA member country competitors.