In news- The United Nations’ World Economic Situation and Prospects 2023 was published recently.

Key highlights of the report-

Following are the key highlights of the report:

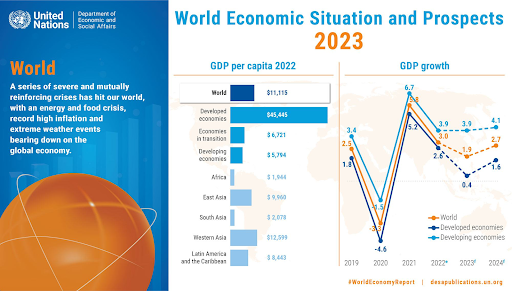

- According to the new report, Global gross domestic product (GDP) is forecast to drop to 1.9 per cent in 2023 from 3 per cent in 2022.

- The reasons are the food and energy crises that hit the world economy hard in 2022, against the backdrop of COVID-19 and the Ukraine war.

- The world’s output growth can bounce back to 2.7 per cent in 2024, subject to a change in the war situation and the disruption of supply chains.

- The world’s average inflation rate was at 9 per cent in 2022, which led to budgetary constraints in several developed as well as developing countries.

- In South Asia, the economic outlook has significantly deteriorated due to high food and energy prices, monetary tightening and fiscal vulnerabilities.

- Average GDP growth is projected to moderate from 5.6 per cent in 2022 to 4.8 per cent in 2023.

- On the contrary, growth in India is expected to remain strong at 5.8 per cent, albeit slightly lower than the estimated 6.4 per cent in 2022, as higher interest rates and a global slowdown weigh on investment and exports.

- The report indicated that India’s food and energy subsidies prevented a major downfall.

- The report said that the prospects are more challenging for other economies in the region. Bangladesh, Pakistan and Sri Lanka sought financial assistance from the International Monetary Fund (IMF) in 2022.

- A slight reversal in poverty eradication was noted in early 2019, but this halted due to the pandemic.

- According to the World Bank, several global crises pushed an additional 75 to 95 million people into extreme poverty in 2022, compared to pre-pandemic projections.

- Income inequalities were evident. Globally, the average income for the bottom 40 per cent was $2,935 in 2021, a slight decline from $2,951 in 2019.

- The average income for the top 10 percent income group increased from $124,668 in 2019 to $126,153 in 2021,18 signalling widening income inequality.

- The International Monetary Fund has an allocation called the Special Drawing Rights (SDR), to provide liquidity to the global financial system in times of emergencies.

- In August 2021, a $650 billion lending was arranged from the SDR, which is the largest amount withdrawn for this purpose in history.

- Of this amount, only $21 billion was allocated to low-income countries. However, some countries such as China donated some of their SDR $10 billion of its $40 billion to African countries.

- While the SDRs remain an important source of liquidity support for countries facing balance-of-payment challenges, the interest rate on them rose sharply in 2022.

- The international community will need to cap interest and charge rates to ensure that the poorest and most vulnerable countries can access the facility to meet near-term financing needs.

- The Group of 20 Common Framework for Debt Treatments is considered the main international debt relief mechanism that was availed of by only three countries.

- It is a programme offered by G20 countries to defer official debt service, particularly by developing countries and low-income countries.