In news– Short seller Hindenburg Research has recently disclosed short positions in Adani Group, alleging stock manipulation and accounting fraud in its latest investigative report.

About Short Selling-

- “Buy low, sell high” is the traditional investment strategy in which one buys a stock or security at a particular price and then sells it when the price is higher, thereby booking a profit.

- This is referred to as a “long position”, and is based on the view that the price of the stock or security will appreciate with time.

- Short selling, or shorting, on the other hand, is a trading strategy based on the expectation that the price of the security will fall.

- Short selling is an investment or trading strategy that speculates on the decline in a stock or other security’s price.

- While fundamentally it is based on the “buy low, sell high” approach, the sequence of transactions is reversed in short selling — to sell high first and buy low later.

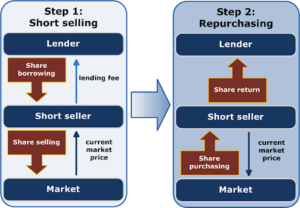

- Also, in short selling, the trader usually does not own the securities he sells, but merely borrows them.

- In the stock market, traders usually short stocks by selling shares they have borrowed from others through brokerages.

- When the price of the shares falls to the expected levels, the trader would purchase the shares at the lower price and return them to the owner, booking a profit in the process.

- If, however, the price of the shares appreciates instead of falling, the trader will be forced to buy shares at a higher price to return to the owner, thereby booking a loss.