Regulatory sandbox is important from the perspective of adopting new technology, consumer awareness and inclusive growth. All these aspects are interrelated for UPSC preparation.

Static dimensions

- What is a regulatory sandbox?

- IFSCA and regulatory sandbox

- Phase 1 of regulatory sandbox

- Regulatory sandbox announced for decongestion of cities

Current dimensions

- In news

Content:

In news:

- The Reserve Bank of India (RBI) has invited companies in the cross-border payments space to apply as part of the second cohort of its regulatory sandbox.

- It released the framework for its regulatory sandbox in August 2019, which would help companies and startups test new payments and lending solutions, under limited regulatory controls and supervision.

- The aim of creating the sandbox is to test a “product’s viability without the need for a larger and more expensive roll-out”.

- It also gives regulators “first-hand empirical evidence on the benefits and risks of emerging technologies and their implication”.

- The Cohort is expected to spur innovations capable of recasting the cross-border payments landscape by leveraging new technologies to meet the needs of a low cost, secure, convenient and transparent system in a faster manner.

- The framework for the sandbox has been updated in order to broadbase the eligibility criteria.

- It has reduced the minimum net-worth requirement from ₹25 lakh to ₹10 lakh and has also allowed Partnership firms and a Limited Liability Partnership to participate in the sandbox.

- Interested entities can apply to participate in the second cohort of the RBI’s sandbox between December 21, 2020 to February 15, 2021.

The RBI has decided that the third cohort of the sandbox will focus on MSME lending solutions.

What is a regulatory sandbox?

- A Regulatory Sandbox (RS) is a framework that allows for live-testing of new products or services in a controlled environment.

- RBI’s framework for a regulatory sandbox outlines a ‘learning by doing’ approach for all ecosystem players.

- With certain safeguards, the regulator allows start-ups/Fintechs/tech companies/banks to innovate their products.

- Regulatory sandbox allows a few cohorts with a limited number of entrants to test their product.

- The cohorts can run at various time periods but shall be completed within six months.

- The presence of appropriate safeguards helps in containing the consequences of failure.

- The sandbox allows for the pilot testing of newly developed technologies.

- RBI has segregated innovation into two parts: Innovative products and services and Innovative technology.

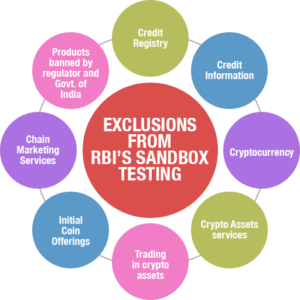

- The regulatory sandbox framework doesn’t allow any FinTechs or start-ups to innovate with cryptocurrency.

- RBI has also given an exclusion list where it will not entertain any innovation.

- For the sandbox framework to work, banks will have to come on board first, then fintechs and startups consume the API (application programming interface) provided by the National Payments Corporation of India (NPCI) and banks.

IFSCA and regulatory sandbox:

- The International Financial Services Centres Authority (IFSCA) has introduced a framework for Regulatory Sandbox.

- Under this Sandbox framework, entities operating in the capital market, banking, insurance and financial services space shall be granted certain facilities and flexibilities to experiment with innovative FinTech solutions in a live environment with a limited set of real customers for a limited time frame.

- These features shall be fortified with necessary safeguards for investor protection and risk mitigation.

- The Regulatory Sandbox shall operate within the IFSC located at GIFT City, Gujarat.

- All entities (regulated as well as unregulated) operating in the capital market, banking, insurance and pension sectors as well as individuals and startups from India and FATF compliant jurisdictions, shall be eligible for participation.

- IFSCA shall assess the applications and extend suitable regulatory relaxations to commence limited purpose testing in the Sandbox.

- Market Infrastructure Institutions (MIIs) operating in the IFSC will manage the Innovation Sandbox.

Phase 1 of regulatory sandbox:

- The Reserve Bank opened the first cohort under the Regulatory Sandbox with ‘Retail Payments’ as its theme.

- It is expected to spur innovation in digital payments space and help in offering payment services to the unserved and underserved segment of the population.

- Migration to digital modes of making a payment can obviate some of the costs associated with a cash economy and can give customers a friction-free experience.

- The innovative products/services shall be considered for inclusion under RS such as:

mobile payments including feature phone based payment services.

Offline payment solutions – Though mobile internet speed has risen, connectivity issues remain unresolved in large areas. Therefore, providing an option of off-line payments through mobile devices for furthering the adoption of digital payments is required.

Contactless payments – Contactless payments, while decreasing the time taken for payment checkout, also ease payments for small ticket payment transactions.

- The live testing of new products or services in a controlled environment may require a bank/NBFC/any other partner for the testing to commence.

- From November 16, 2020, two entities – Natural Support Consultancy Services Pvt Ltd, Jaipur and Nucleus Software Exports Ltd, New Delhi started testing of their products under its RS- First cohort on Retail Payments – Test Phase.

Natural Support Consultancy Services’ product ‘eRupaya’ is a set of Near-Field Communication (NFC) based Prepaid card and NFC-enabled Point of Sale (PoS) device to facilitate offline Person-to-Merchant (P2M) transactions and offline digital payments in remote locations and the offline digital cash product, ‘PaySe’, of Nucleus Software Exports will help connect with rural areas for e-payments.

Regulatory sandbox announced for decongestion of cities:

- Startups could soon get to try out novel transport models in cities under regulatory sandboxes to live-test promising services, as the government bets on innovation in mobility to ease urban congestion.

- The government is ready to provide a regulatory sandbox to any company that comes with a better (transport) model and help them to fine-tune their model.

- The government is open to the idea of startups or companies introducing fresh mobility models beyond cab aggregation as it has already become established.

- Car pooling, bike taxi and other micro mobility options offered by startups are also gaining popularity.

- Though there can be one common idea, implementation will have to vary from state-to–state depending on mobility requirements.

- Explain the utility of a Regulatory Sandbox (RS). How does the RS announced by RBI spur innovation and growth?

Approach to the answer:

- Define Regulatory Sandbox (RS)

- Write about its importance

- Write the advantages of phase-1 of RS

- Explain the newly announced phase -2 of RS and its advantage

- Conclusion