Manifest Pedagogy:

A cryptocurrency is a type of digital asset that is based on a network that is distributed across many computers.The most important characteristic of a cryptocurrency is that it is not controlled by any central authority – the decentralized nature of the blockchain renders cryptocurrencies theoretically immune to traditional methods of government control and interference.Regardless of the investment prospects of cryptocurrencies, a proper regulatory framework may help in protecting retail investors, at least from outright scams.

In News: Bitcoin, the most dominant cryptocurrency around, has lost a fourth of its value in the matter of a few months.

Static Dimensions

- About Crypto currency

- Why does demand for crypto currency exist ?

Current Dimensions

- Present situation on cryptocurrency

- Why regulation is needed

- Government stand on Cryptocurrency

- Government measures taken

- Wayforward

Content

About Crypto currency-

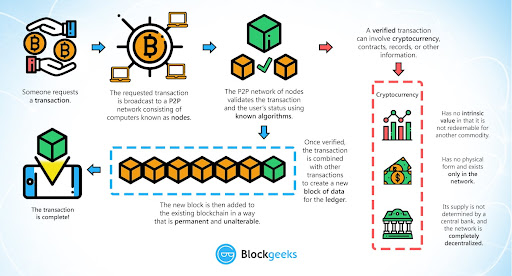

- The term “crypto” refers to the encryption algorithms and cryptographic techniques used to protect these entries, such as elliptical curve encryption, public-private key pairs, and hashing functions.

- Cryptocurrencies can be mined or bought on cryptocurrency exchanges.

- A cryptocurrency is an internet-based medium of exchange that conducts financial transactions using cryptographic functions.

- It makes use of blockchain technology to achieve decentralization, transparency, and immutability (the ability of a blockchain ledger to remain unchanged, unaltered, and indelible.

- It is a type of digital asset that is based on a network that is distributed across many computers.

- Because of their decentralized structure, they can exist independently of governments and central authorities.

- Some popular Cryptos-

- Bitcoin: Introduced in 2009 Created by “Satoshi Nakamoto” (Real name and identity unknown). It is the world’s first successful cryptocurrency.

- Dogecoin: Introduced in 2013 by Jackson Palmer and later Billy Markus. Dogecoin is a digital currency like bitcoin or ethereum.

- Ethereum: Launched in 2015, created by Vitalik Buterin.

- Litecoin: Introduced in 2011 Created by Charlie Lee. Litecoin is unique from Bitcoin in that it can produce a greater number of coins and its transaction speed is faster.

- Cryptocurrencies are not widely accepted as money, owing to their lack of legal tender status.

- The Central African Republic (CAR) became the second country after El Salvador to adopt Bitcoin as legal tender.

Present situation on cryptocurrency

- The crash in the price of cryptocurrencies is a timely reminder to retail investors to stay far away from this highly speculative asset class.

- Bitcoin, the most popular cryptocurrency, has lost over two-thirds of its value since its peak in November last year and has wiped out many retail investors.

- Other cryptocurrencies have witnessed even larger losses with some (Luna) plunging to zero.

- The crash in the crypto market amidst wider market correction has put to rest the argument that crypto, as an asset class, is as good a hedge as precious metals.

- The acceptability of cryptocurrencies in the wider economy has remained minuscule and there are no signs of their use for purposes other than wild speculation.

- Just as Internet stocks and tulip bulbs were the hallmarks of liquidity-fuelled bubbles in the past, cryptocurrencies are the leading symbol of the current bubble in markets.

Why does demand for crypto currency exist ?

- The supply of a lot of cryptocurrencies is limited by design, investing in them seemed like a good way to protect one’s wealth from inflation fuelled by central banks.

- Cryptocurrencies were now touted as an independent asset class like gold and silver that could serve as an effective hedge in times of crisis.

- Cryptocurrencies make it possible to lend, sell, buy, or borrow without an identity, credit score, or even a bank.

- Some coins are used to transfer value (measured in a currency like dollars) cheaper and faster than using credit or conventional means.

- Cryptocurrencies typically use decentralized control as opposed to a central bank digital currency.

- No entry barriers, unlike conventional banking systems.

Why regulation is needed for Cryptocurrency?

- Cryptocurrencies are not an alternative to traditional currencies as fiat money.

- They are not units of account, and their conversion rates to traditional currencies are volatile enough to be not called a stable store of value.

- Recent research suggests that the volatility of Bitcoin (the cryptocurrency with the largest market cap) is ten times higher than that of major exchange rates (US dollar against the euro and the yen).

- Regulatory bypass: A central bank cannot regulate the supply of cryptocurrencies in the economy. This could pose a risk to the financial stability of the country if their use becomes widespread.

- Cryptocurrencies are significantly illiquid in terms of higher transaction costs. Between 2020 and 2021, fees ranged from $2-60 per transaction.

- The inefficiency of the distributed ledger system limits the speed of transactions, making them unsuitable as an efficient mode of exchange.

- A recent Deutsche Bank report reveals that the Bitcoin network can process only about 600,000 transactions per day compared to Visa’s two billion transactions.

- The slow clearing process can substantially increase the quantum and spread of transaction fees.

- Cryptocurrencies are too risky, even as speculative assets. All speculative assets, real or financial, have some intrinsic economic value that cryptocurrencies do not have.

- High volatility renders cryptocurrencies a poor risk-diversifier in portfolios. Hence, comparing them with bullion as a risk-diversifier is also wrong.

- Cryptocurrencies can be a social evil as well. Their usage as currency on the dark web, in the trade of illegal goods (such as drugs) and even in funding terrorism is now known. They are more vulnerable to criminal activity and money laundering.

- Cryptocurrencies are also issued by individuals, privately. Therefore, the critical question is whether to trust an anonymous group of people who may be exploitative without accountability or a sovereign government accountable.

- In a time of excessive monetary liquidity, speculative mania for cryptocurrencies may promote inequality.

- It can be conjectured that savvy investors -typically wealthier, more connected ones are likely to be leaders while the poorer, less connected ones are likely to be followers.

- The information asymmetry will let the smart money profit at the expense of naive investors. With severe disparity in financial literacy and easy digital access, India could be the hotbed of financial exploitation.

- Security risks: Cyberattacks on wallets, exchange mechanism (Cryptojacking).

Government stand on Cryptocurrency-

- Governments and the central bank have been largely unwilling to recognise cryptocurrencies as a legitimate investment asset.

- They are also unlikely to recognise private cryptocurrencies as they infringe on the state’s fiscal and monetary authority.

- This hostile attitude is at least partly to blame for the shady nature of the crypto industry at large.

- Retail investors looking for quick market gains have had to plunge into an unregulated space marked by scams and other pitfalls in the absence of a legal environment that can protect investor interests.

Government measures taken-

- In 2018, the RBI issued a circular preventing all banks from dealing in cryptocurrencies. This circular was declared unconstitutional by the Supreme Court in May 2020.

- The government has announced to introduce a bill- ‘Cryptocurrency and Regulation of Official Digital Currency Bill, 2021’, to create a sovereign digital currency and simultaneously ban all private cryptocurrencies.

- The Union Budget 2022-2023 of India has also proposed to introduce a digital currency in the coming financial year.

- It was also announced that “any income from transfer of any virtual digital asset shall be taxed at the rate of 30%.

- RBI exploring DLT (Distributed Ledger Technology) based Central Bank Digital Currency.

- Under DLT, details are recorded in multiple places at the same time.

- For ex: Blockchain is just one type of distributed ledger.

- Central Bank Digital Currency (CBDC): It will be a legal tender, can be converted/exchanged at par with similarly denominated cash.

Way Forward-

- Regulating cryptocurrencies is necessary to avoid significant issues, ensure that they are not mishandled, and shield naive investors from high market volatility and potential ripoffs.

- The regulation must be unambiguous, transparent, and logical, and it must be driven by an overarching goal.

- A legal and regulatory framework must define crypto-currencies as securities or other financial instruments under applicable national laws and identify the regulatory authority in charge

- Rather than outright prohibiting cryptocurrencies, the government should regulate their trading by instituting stringent KYC norms, reporting, and taxation.

- A number of measures, including record-keeping, inspections, independent audits, investor grievance redress, and dispute settlement, may be used to address concerns about transparency, information accessibility, and consumer protection.

- By generating job possibilities at all levels, from blockchain developers to designers, project managers, business analysts, promoters, and marketers, cryptocurrencies and Blockchain technology have the ability to revive the entrepreneurial spirit in India’s startup environment.

Mould your thoughts

- “Blockchain and cryptocurrency will be an integral part of the Fourth Industrial Revolution”. In the light of the above statement, analyse the need for robust regulation of cryptocurrency in India. (250 Words)

Approach to the answer-

- Introduction about Cryptocurrency and blockchain.

- Significance of cryptocurrency

- Challenges associated which calls for regulation

- Measures that can be taken

- Government’s stand and measures

- Wayforward and conclusion