About Ponzi scheme

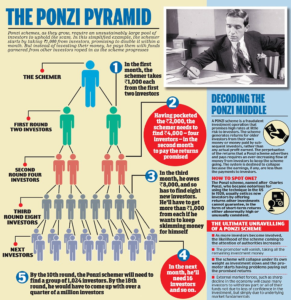

- A Ponzi scheme is a fraudulent investing scam promising high rates of return with little risk to investors.

- A Ponzi scheme is a fraudulent investing scam which generates returns for earlier investors with money taken from later investors.

- The scheme leads victims to believe that profits are coming from product sales or other means, and they remain unaware that the later investors are the source of their returns.

- The scheme traces its origin to a person named Charles Ponzi, who became notorious for using the technique in the 1920s.

Understanding Ponzi Schemes

- A Ponzi scheme is an investment fraud in which clients are promised a large profit at little to no risk.

- Companies that engage in a Ponzi scheme focus all of their energy into attracting new clients to make investments.

- This new income is used to pay original investors their returns, marked as a profit from a legitimate transaction.

- Ponzi schemes rely on a constant flow of new investments to continue to provide returns to older investors.

- When this flow runs out, the scheme falls apart.

Characteristics of Ponzi scheme

- High investment returns with little or no risk

- Overly consistent returns

- Unregistered investments

- Unlicensed sellers

- Secretive or complex strategies

- Difficulty receiving payments

Government efforts to control Ponzi scheme

- Currently the Ponzi scheme frauds are dealt by Enforcement Directorate under Prevention of Money Laundering Act, 2002.

- Attempts to regulate Ponzi schemes have taken the form of SEBI’s ‘collective investment scheme’ regulations.

- The central government has formulated a Banning of Unregulated Deposit Schemes Bill. This was approved by Lok Sabha but is pending in the Rajya Sabha.

Regulators Overseeing Deposit-taking Schemes

- The nine authorities charged with the oversight and regulation of deposit-taking schemes include the Reserve Bank of India (RBI), the Securities and Exchange Board of India (Sebi), the Ministry of Corporate Affairs (MCA), and state and Union Territory governments.

- Each authority oversees different types of deposit-taking schemes, with the RBI overseeing deposits taken by non-banking financial companies (NBFCs).

- Sebi oversees mutual funds.

- Any deposit-taking scheme must be registered with the relevant authority, based on the category it falls under, and only then is its operation legal.