In news

Centre waves compound interest on loans up to Rs. 2 Crore

About the Loan cash back scheme

- Eligibility: The compound interest waiver is for most of the loans — housing, MSME, education, consumer durable, credit card dues, automobile, consumption and personal loans to professionals

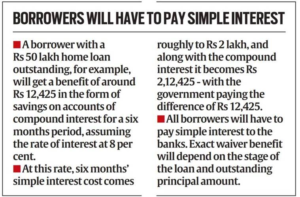

- The difference between the compound interest and simple interest for a period of six months will be provided to all borrowers with loans up to Rs 2 crore.

- In other words, borrowers need to pay only simple interest and the government will pay back the difference between compound interest charged during those six months and simple interest.

- As per the scheme, the ex gratia payment will be admissible irrespective of whether the borrower had fully availed or partially availed or not available of the moratorium on repayment.

- It is for those loan accounts which are standard and not non-performing assets (NPAs) as on February 29.

- It also states that, for loan accounts which were closed during this period, the ex gratia payment will be made from March 1, 2020 till the date of closure of such account.

- Not eligible: Any borrower whose aggregate of all facilities with lending institutions is more than Rs 2 crore — sanctioned limits or outstanding amounts — will not be eligible for the waiver

- The waiver will be provided by all private and state-owned banks, cooperative banks, regional rural banks, housing finance companies and non-banking financial institutions.

- Rate of interest: The rate of interest used to calculate the ex gratia amount will be based on the contracted rate specified for most loans

Calculation of interest:

- Union government has specified that for reimbursement, the compounding of interest should be reckoned on a monthly basis.

- The interest rate to be applied for calculating the difference will be the contracted rate as specified in the loan agreement.

- For credit card dues, the rate of interest will be the weighted average of lending rate (WALR) charged by the card issuer for transactions financed on the EMI basis from its customers during the period from March 1, 2020 to August 31, 2020.

- The computation of WALR should be certified by the statutory auditor of the card issuer.

- With respect to education, housing, consumer durables, credit card dues, auto, consumption and personal loans are in the form of a term loan or demand loan and not an overdraft facility or cash credit, the outstanding in the account as on February 29, 2020 will be the reference amount for calculation of simple interest.

Source: The Indian Express