In news : The United Nations Conference on Trade and Development (UNCTAD) has released the Investment Trends Monitor Report recently

Key findings of the report

India’s status

- As per the report, saw a 13 per cent rise in FDI saw the total foreign investments boosted by investments in the digital sector for 2020 touching $57 billion

- India’s 13% rise in FDI saw the total foreign investments for 2020 touching $57 billion.

- The report noted that acquisitions in India’s digital economy was the largest contributor to this rise.

- Further, India and Turkey are attracting record numbers of deals in information consulting and digital sectors, including e-commerce platforms, data processing services and digital payments.

Global scenario

Global foreign direct investment (FDI):

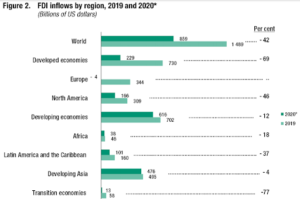

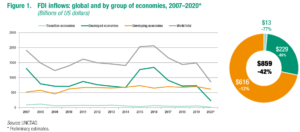

- It has collapsed in 2020, falling by 42% to an estimated $859 billion, from $1.5 trillion in 2019 FDI finished 2020 more than 30% below the trough after the global financial crisis in 2009 and back at a level last seen in the 1990s.

- The decline was concentrated in developed countries, where FDI flows fell by 69% to an estimated $229 billion.

- Europe: Flows to Europe dried up completely to -4 billion (including large negative flows in several countries).

- A sharp decrease was also recorded in the United States (-49%) to $134 billion.

- The declining trend was also seen in Russia and the U.K

- Developing countries:

- The decline in developing economies was relatively measured at -12% to an estimated $616 billion.

- The share of developing economies in global FDI reached 72% – the highest share on record. China topped the ranking of the largest FDI recipients.

- The fall in FDI flows across developing regions was uneven, with -37% in Latin America and the Caribbean, -18% in Africa and -4% in developing Asia.

- East Asia was the largest host region, accounting for one-third of global FDI in 2020. FDI to the transition economies declined by 77% to $13 billion.

Cross-border merger and acquisition (M&A) sales

It grew 83% to $27 billion, citing social networking giant Facebook’s acquisition of 9.9% stake in Reliance Jio platforms, via a new entity, Jaadhu Holdings LLC. Similarly, deals in the energy sector propped up M&A values in IndiaFlows to North America declined by 46% to $166 billion, with cross-border mergers and acquisitions dropping by 43%. Announced greenfield investment projects also fell by 29% and project finance deals tumbled by 2%.

Projections for 2021

- Despite projections for the global economy to recover in 2021, the UNCTAD expects FDI flows to remain weak due to uncertainty over the evolution of the COVID-19 pandemic. The organisation has projected a 5% to 10% FDI slide in 2021 in last year’s World Investment Report

- Looking ahead, the FDI trend is expected to remain weak in 2021. Data on an announcement basis, an indicator of forward trends, provides a mixed picture and point at continued downward pressure.

- Sharply lower greenfield project announcements (-35% in 2020) suggest a turnaround in industrial sectors.

- Similarly, the 2020 decline in cross-border M&As (-10%) was cushioned by higher values in the last part of the year.

- Looking at M&A announcements, strong deal activity in technology and pharmaceutical industries is expected to push M&A-driven FDI flows higher.

- The report said that for developing countries, the trends in greenfield and project finance announcements are a major concern

- As per the report, overall FDI flows in developing economies appear relatively resilient, greenfield announcements fell by 46% and international project finance by 7%. These investment types are crucial for productive capacity and infrastructure development and thus for sustainable recovery prospects.

- It further adds that risks related to the latest wave of the pandemic, the pace of the roll-out of vaccination programmes and economic support packages, fragile macroeconomic situations in major emerging markets, and uncertainty about the global policy environment for investment will all continue to affect FDI in 2021