Inverted duty structure (IDS)

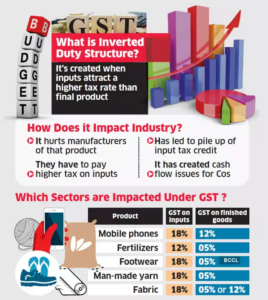

- Inverted duty structure (IDS) is a situation where the rate of tax on inputs used is higher than the rate of tax on the finished goods.

- Take an imaginary situation of the tyre industry, the tax rate on natural rubber (input) purchased is 10% whereas the tax rate on rubber tyre is 5%. Here since the tax rate on input is higher than that on the finished good, there is an inverted tax structure.

- The normal situation is that tax on inputs used is lower than the tax rate of the finished goods. Inverted duty structure is usually prevalent in the case of customs duty (import duty).

What is Inverted Duty Structure under GST?

- The same situation of inverted duty structure is occurring in GST as well.

- Understandably, a producer may be using inputs to produce his finished product. But the tax rate of the inputs may be higher than that of the finished goods.

- So, under GST, inverted duty structure means inputs (inward supplies) used are having a higher GST rate compared to the GST rate of finished goods (outward supplies).

- In simple terms, it means GST rate for raw materials have a higher tax rate whereas the GST rate on finished goods are lower.

What are the problems with the current inverted duty structure under GST?

The inverted duty structure is causing several administrative problems in our GST system.

- Taxpayers will have accumulated credits in the form of refund claims with the tax Department.

- The inverted duty structure is a revenue loss for the government as it has to refund the tax already paid (in inputs).

- Under GST, the inverted duty structure is identified for goods and not for services. Or in other words, there is recognition for ‘input good’ and not for ‘input services’.