In news– In order to deal with insolvency of firms in the financial sector, the Finance Ministry has recently sought views of the Reserve Bank of India (RBI) on drafting a modified version of the FRDI Bill which was withdrawn in 2018.

About the FRDI Bill-

- The Parliament had passed FRDI Bill in 2017, however, it was withdrawn in 2018.

- The bill was meant to address the issue of insolvency of firms in the financial sector — so that if a bank, NBFC, an insurance company, a pension fund or a mutual fund-run by an asset management company fails, a quick solution is available to either sell that firm, merge it with another firm, or close it down, with the least disruption to the system and other stakeholders.

- The Bill was withdrawn due to concerns among the public over safety of deposits despite assurances by the Central government.

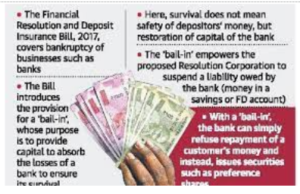

- A key point of criticism was the so-called bail-in clause in the Bill that said in case of insolvency in a bank, the depositors will have to bear a part of the cost of the resolution by a corresponding reduction in their claims.

- The government had then clarified that the bail-in clause would not be applied to public sector banks and it would be a tool of last resort, when a merger or acquisition is not viable, in the case of private sector banks.

- A Financial Resolution Corporation(FRC) was envisaged under the law as an agency that will classify firms according to the risks they pose, carry out inspections and, at a later stage, take over control.

- It had proposed that FRC may classify financial firms under five categories, based on their risk of failure. These categories in the order of increasing risk are: (i) low, (ii) moderate, (iii) material, (iv) imminent, and (v) critical.

- Now under a modified version, in order to allay fears of depositors the deposit insurance cover has also been raised to Rs 5 lakh from Rs 1 lakh per account.

Prompt Corrective Action(PCA) framework-

- RBI has come out with a Prompt Corrective Action(PCA) framework for NBFCs (non-banking financial companies).

- The objective of the PCA Framework is to enable Supervisory intervention at appropriate time and require the Supervised Entity to initiate and implement remedial measures in a timely manner, so as to restore its financial health.

- The central bank has defined three risk thresholds for applying prompt corrective action to NBFCs.

- The PCA Framework is also intended to act as a tool for effective market discipline.

- The decision on the PCA framework came after four big finance firms — IL&FS, DHFL, SREI and Reliance Capital — which collected public funds through fixed deposits and non-convertible debentures collapsed in the last three years despite the tight monitoring in the financial sector.