- COVID-19 pandemic ensued global economic downturn, the most severe one since the Global Financial Crisis

- The lockdowns and social distancing norms brought the already slowing global economy to a standstill

- Global economic output estimated to fall by 3.5% in 2020 (IMF January 2021 estimates)

- Governments and central banks across the globe deployed various policy tools to support their economies such as lowering policy rates, quantitative easing measures, etc.

- India adopted a four-pillar strategy of containment, fiscal, financial, and long-term structural reforms:

- Calibrated fiscal and monetary support was provided, cushioning the vulnerable during the lockdown and boosting consumption and investment while unlocking

- A favourable monetary policy ensured abundant liquidity and immediate relief to debtors while unclogging monetary policy transmission

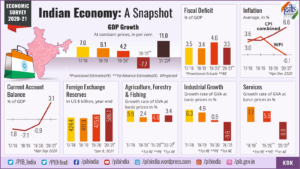

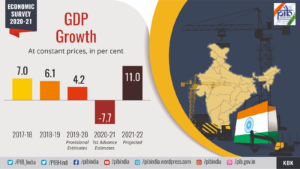

- As per the advance estimates by NSO, India’s GDP is estimated to grow by (-) 7.7% in FY21 – a robust sequential growth of 23.9% in H2: FY21 over H1: FY21

- India’s real GDP to record a 11.0% growth in FY 2021-22 and nominal GDP to grow by 15.4% – the highest since independence:

- Rebound to be led by low base and continued normalization in economic activities as the rollout of COVID-19 vaccines gathers traction

- Government consumption and net exports cushioned the growth from diving further down, whereas investment and private consumption pulled it down

- The recovery in second half of FY 2020-21 is expected to be powered by government consumption, estimated to grow at 17% YoY

- Exports expected to decline by 5.8% and imports by 11.3% in the second half of FY21

- India expected to have a Current Account Surplus of 2% of GDP in FY21, a historic high after 17 years

- On supply side, Gross Value Added (GVA) growth pegged at -7.2% in FY21 as against 3.9% in FY20:

- Agriculture set to cushion the shock of the COVID-19 pandemic on the Indian economy in FY21 with a growth of 3.4%

- Industry and services estimated to contract by 9.6% and 8.8% respectively during FY21

- Agriculture remained the silver lining while contact-based services, manufacturing, construction were hit hardest, and recovering steadily

- India remained a preferred investment destination in FY 2020-21 with FDI pouring in amidst global asset shifts towards equities and prospects of quicker recovery in emerging economies:

- Net FPI inflows recorded an all-time monthly high of US$ 9.8 billion in November 2020, as investors’ risk appetite returned

- India was the only country among emerging markets to receive equity FII inflows in 2020

- Buoyant SENSEX and NIFTY resulted in India’s market-cap to GDP ratio crossing 100% for the first time since October 2010

- Softening of CPI inflation recently reflects easing of supply side constraints that affected food inflation

- Mild contraction of 0.8% in investment (as measured by Gross Fixed Capital Formation) in 2nd half of FY21, as against 29% drop in 1st half of FY21

- Reignited inter and intra state movement and record-high monthly GST collections have marked the unlocking of industrial and commercial activity

- The external sector provided an effective cushion to growth with India recording a Current Account Surplus of 3.1% of GDP in the first half of FY21:

- Strong services exports and weak demand leading to a sharper contraction in imports (merchandise imports contracted by 39.7%) than exports (merchandise exports contracted by 21.2%)

- Forex reserves increased to a level so as to cover 18 months worth of imports in December 2020

- External debt as a ratio to GDP increased to 21.6% at end-September 2020 from 20.6% at end-March 2020

- Ratio of forex reserves to total and short-term debt improved because of the sizable accretion in reserves

- V-shaped recovery is underway, as demonstrated by a sustained resurgence in high frequency indicators such as power demand, e-way bills, GST collection, steel consumption, etc.

- India became the fastest country to roll-out 10 lakh vaccines in 6 days and also emerged as a leading supplier of the vaccine to neighbouring countries and Brazil

- Economy’s homecoming to normalcy brought closer by the initiation of a mega vaccination drive:

- Hopes of a robust recovery in services sector, consumption, and investment have been rekindled

- Reforms must go on to enable India realize its potential growth and erase the adverse impact of the pandemic

- India’s mature policy response to the ‘once-in-a-century’ crisis provides important lessons for democracies to avoid myopic policy-making and demonstrates benefits of focusing on long-term gains

| Major Structural Reforms Undertaken as a Part of Atmanirbhar Bharat Package | |

| Sector | Structural Reform Undertaken |

| Deregulation and Liberalization of Sectors | |

| Agriculture |

|

| MSMEs |

|

| Labour |

|

| Business Process Outsourcing (BPO) | Simplification of the Other Service Provider (OSP) guidelines of the Department of Telecom. Several requirements, which prevented companies from adopting ‘Work from Home’ and ‘Work from Anywhere’ policies have been removed |

| Power |

|

| PSUs |

|

| Mineral Sector |

|

| Strengthening Productive Capacity | |

| Industry |

|

| Space |

|

| Defence |

|

| Strengthening Productive Capacity | |

| Education |

|

| Social Infrastructure | Scheme for Financial Support to Public Private Partnerships (PPPs) in Infrastructure Viability Gap Funding (VGF) Scheme extended till 2024-25 |

| Ease of Doing Business | |

| Financial Markets |

|

| Corporates |

|

| Administration |

|