- COVID-19 pandemic led to a sharp decline in global trade, lower commodity prices and tighter external financing conditions with implications for current account balances and currencies of different countries

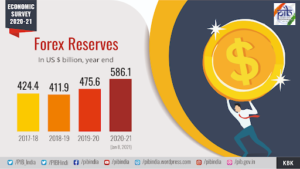

- India’s forex reserves at an all-time high of US$ 586.1 billion as on January 08, 2021, covering about 18 months worth of imports

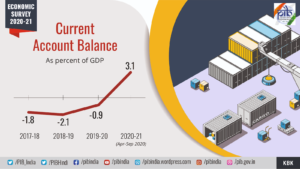

- India experiencing a Current Account Surplus along with robust capital inflows leading to a BoP surplus since Q4 of FY 2019-20

- Balance on the capital account is buttressed by robust FDI and FPI inflows:

- Net FDI inflows of US$ 27.5 billion during April-October, 2020: 14.8% higher as compared to first seven months of FY 2019-20

- Net FPI inflows of US$ 28.5 billion during April-December, 2020 as against US$ 12.3 billion in corresponding period of last year

- In H1: FY21, steep contraction in merchandise imports and lower outgo for travel services led to:

- Sharper fall in current payments (by 30.8%) than current receipts (15.1%)

- Current Account Surplus of US$ 34.7 billion (3.1% of GDP)

- Balance on the capital account is buttressed by robust FDI and FPI inflows:

- India to end with an Annual Current Account Surplus after a period of 17 years

- India’s merchandise trade deficit was lower at US$ 57.5 billion in April-December, 2020 as compared to US$ 125.9 billion in the corresponding period last year

- In April-December, 2020, merchandise exports contracted by 15.7% to US$ 200.8 billion from US$ 238.3 billion in April-December, 2019:

- Petroleum, Oil and Lubricants (POL) exports have contributed negatively to export performance during the period under review

- Non-POL exports turned positive and helped in improving export performance in Q3 of 2020-21

- Within Non-POL exports, agriculture & allied products, drugs & pharmaceutical and ores & minerals recorded expansion

- Total merchandise imports declined by (-) 29.1% to US$ 258.3 billion during April-December, 2020 from US$ 364.2 billion during the same period last year:

- Sharp decline in POL imports pulled down the overall import growth

- Imports contracted sharply in Q1 of 2020-21; the pace of contraction eased in subsequent quarters, due to the accelerated positive growth in Gold and Silver imports and narrowing contraction in non-POL, non-Gold & non-Silver imports

- Fertilizers, vegetable oil, drugs & pharmaceuticals and computer hardware & peripherals have contributed positively to the growth of non-POL, non-Gold & non-Silver imports

- Sharp decline in POL imports pulled down the overall import growth

- Trade balance with China and the US improved as imports slowed

- Net services receipts amounting to US$ 41.7 billion remained stable in April-September 2020 as compared with US$ 40.5 billion in corresponding period a year ago.

- Resilience of the services sector was primarily driven by software services, which accounted for 49% of total services exports

- Net private transfer receipts, mainly representing remittances by Indians employed overseas, totaling US$ 35.8 billion in H1: FY21 declined by 6.7% over the corresponding period of previous year

- At end-September 2020, India’s external debt was placed at US$ 556.2 billion – a decrease of US$ 2.0 billion (0.4%) as compared to end-March 2020.

- Improvement in debt vulnerability indicators:

- Ratio of forex reserves to total and short-term debt (original and residual)

- Ratio of short-term debt (original maturity) to the total stock of external debt.

- Debt service ratio (principal repayment plus interest payment) increased to 9.7% as at end-September 2020, compared to 6.5% as at end-March 2020

- Rupee appreciation/depreciation:

- In terms of 6-currency nominal effective exchange rate (NEER) (trade-based weights), Rupee depreciated by 4.1% in December 2020 over March 2020; appreciated by 2.9% in terms of real effective exchange rate (REER)

- In terms of 36-currency NEER (trade-based weights), Rupee depreciated by 2.9% in December 2020 over March 2020; appreciated by 2.2% in terms of REER

- RBI’s interventions in forex markets ensured financial stability and orderly conditions, controlling the volatility and one-sided appreciation of the Rupee

Initiatives undertaken to promote exports:

- Production Linked Incentive (PLI) Scheme

- Remission of Duties and Taxes on Exported Products (RoDTEP)

- Improvement in logistics infrastructure and digital initiatives

Source: PIB & Economic Survey