Manifest Pedagogy:

CBDC is the legal tender issued by a central bank in a digital form. It is the same as a fiat currency and is exchangeable one-to-one with the fiat currency.CBDCs have the potential to lead to greater financial inclusion, but a concept note issued by the Reserve Bank of India also rightly places emphasis on consumer protection.More discussion on the implications of CBDCs on bank runs, monetary policy transmission and central bank’s balance-sheets is needed to ensure that CBDC is issued with adequate safeguards to counter potential risks.

In News:The Reserve Bank of India (RBI) issued a concept note on the Central Bank Digital Currency (CBDC).

Placing it in the Syllabus: Economy and Science and Technology

Static Dimensions

- About Central Bank Digital Currency (CBDC)

- Types and design features of CBDCs

Current Dimensions

- Background

- Need of issuing CBDCs

- Benefits of CBDC

- Risks associated with CBDC

Content

Background

- The Reserve Bank of India’s (RBI) digital rupee the Central Bank Digital Currency (CBDC) may be introduced in phases beginning with wholesale businesses in the current financial year.

- In the Budget speech on February 1, Finance Minister Nirmala Sitharaman had said that the central bank would launch the CBDC in the financial year 2022-23.

- RBI, which has repeatedly voiced its opposition to private digital currencies, had proposed to the government in October last year to widen the scope of the paper rupee to include currency in a digital form.

- RBI had proposed amendments to the Reserve Bank of India Act, 1934, which would enable it to launch a CBDC.

About Central Bank Digital Currency (CBDC)

- A CBDC is a central-bank-issued digital money denominated in a sovereign currency. It is the same as cash but in digital form. It will be used as a medium of exchange rather than as an asset.

- CBDC is the legal tender issued in a digital form. It is the same as a fiat currency and is exchangeable one-to-one with the fiat currency.

- Only its form is different.” The digital fiat currency or CBDC can be transacted using wallets backed by blockchain.

- Though the concept of CBDCs was directly inspired by Bitcoin, it is different from decentralised virtual currencies and crypto assets, which are not issued by the state and lack the ‘legal tender’ status.

- CBDCs enable the user to conduct both domestic and cross-border transactions which do not require a third party or a bank.

Types and design features of CBDCs

- Based on the accessibility, the concept note distinguishes between wholesale and retail CBDCs.

- Retail CBDC would be available for use by all: private sector, non-financial consumers and businesses.

- Wholesale CBDCs are designed for restricted access by financial institutions.

- The possibility of using wholesale CBDCs for buying assets such as government securities, commercial papers and primary auctions for government securities bypassing the bank route.

- Retail CBDC is an electronic version of cash. CBDC can provide an alternative medium of making digital payments in case of operational or technical problems leading to disruption in other payment system infrastructures.

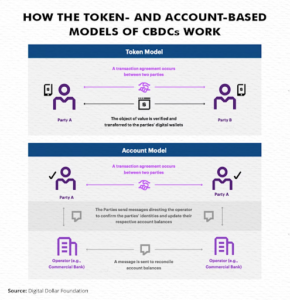

- CBDC can be token-based or account-based.

- A token-based CBDC is a digital token representing a claim on the central bank.

- The transfer of tokens would entail transfer of ownership similar to handing over banknotes from one person to another.

- Tokens would be stored through “wallets” similar to the technology employed by cryptocurrency users.

- In an account-based CBDC, the central bank would hold accounts for users of the CBDC.

- Money would be held as credit balances in accounts.

- Both designs will have separate legal considerations and will require suitable amendments to the legal framework.

- A token-based CBDC is a digital token representing a claim on the central bank.

Need of issuing CBDCs

- Currently, 105 countries are exploring CBDC, accounting for 95 per cent of the global GDP.

- These include 19 of the G20 countries, as per Atlantic Council’s data. Out of these, 50 countries are in an advanced phase of exploration: launch, pilot or development.

- A review of international experience suggests that one of the key motivations for issuing CBDCs has been to foster financial inclusion.

- For instance, in the Bahamas, the Sand Dollar was introduced in order to facilitate financial inclusion because its population was spread across 30 islands, many of them remote.

- In countries facing dwindling usage of cash, such as Sweden, central banks issue CBDCs as a digital complement to cash.

- Some countries, such as Japan are exploring CBDCs as a payment instrument alongside cash and also to ensure stability and efficiency of the payments system.

- A key motivation behind issuing CBDCs in India is to reduce the cost of physical cash management.

- A CBDC would reduce costs related to printing, storage, transportation and replacement of banknotes.

- Despite significant push to digitisation, the usage of cash remains high, particularly for small value transactions.

- Cash is favoured for its anonymity. If reasonable anonymity is assured, the public may shift from cash to the CBDC for regular transactions and small value payments, thus furthering digitisation.

Benefits of CBDC

- Introduction of CBDC has the potential to provide significant benefits, such as reduced dependency on cash, higher seigniorage due to lower transaction costs, and reduced settlement risk.

- Introduction of CBDC would also possibly lead to a more robust, efficient, trusted, regulated and legal tender-based payments option.

- RBI has repeatedly flagged concerns over money laundering, terror financing, tax evasion, etc with private cryptocurrencies like Bitcoin, Ether, etc.

- Introducing its own CBDC has been seen as a way to bridge the advantages and risks of digital currency

- CBDCs as a safe alternative to private virtual currencies.

- There are several models proposed by technology experts and evangelists on how the digital rupee could be transacted, and the formal announcement by the RBI will likely provide the details.

- One chief difference could be that a digital rupee transaction would be instantaneous as opposed to the current digital payment experience.

- If there are concerns about the banking sector’s health or during economic instability, depositors may switch from bank deposits to CBDCs.

- Introduction of CBDCs could support competition and innovation in payments and settlements by providing another avenue to the public.

- CBDCs could potentially promote financial inclusion by making financial services more accessible to the unbanked and underbanked population.

- This would require suitable design choices including offline functionality of CBDCs.

Risks associated with CBDC

- Potential cybersecurity threat.

- Lack of digital literacy of the population.

- Threat to Privacy-The digital currency must collect certain basic information of an individual so that the person can prove that he’s the holder of that digital currency.

- The roll out of CBDCs has many potential benefits, it may also pose risks to financial stability.

- The risks would vary depending upon whether the CBDC is interest-bearing (remunerated) or non-interest bearing (non-remunerated).

- If accounts with central banks offer interest, then there will be an incentive for people to move their deposits in banks to CBDC accounts.

- This could have adverse implications for credit creation by commercial banks. Banks would have to offer higher interest rates on deposits, thus increasing their cost of funding.

- Banks may be compelled to pass on the additional costs to borrowers.

- They may also turn to riskier sources for generating higher returns.

- The reliance on central bank’s liquidity could also increase.

- If a CBDC is non-remunerated, the incentive to shift from bank deposits would be lesser.

Wayforward

- There are associated risks, no doubt, but they need to be carefully evaluated against the potential benefits.

- The financial data collected on digital currency transactions will be sensitive in nature, and the government will have to carefully think through the regulatory design.

- This would require close interaction between the banking and data protection regulators.

- The RBI will have to map the technology landscape thoroughly and proceed cautiously with picking the correct technology for introducing CBDCs.

- The data stored with the central bank in a centralised system will hold grave security risks, and robust data security systems will have to be set up to prevent data breaches.

- It would be the RBI’s endeavour, as we move forward in the direction of India’s CBDC, to take the necessary steps which would reiterate the leadership position of India in payment systems.

Mould your thoughts

- Central bank digital currency has the potential to revolutionise the payment ecosystem in the country. Critically Discuss (250 words)

Approach to the answer.

- Introduction about CBDC

- Need for CBDC

- Benefits associated

- Risks involved

- Wayforward and conclusion