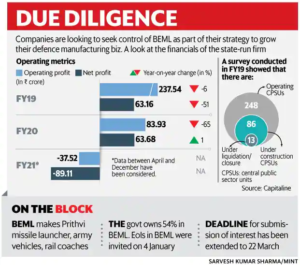

In News: At least six companies, including Tata Motors Ltd, Mahindra and Mahindra Ltd and Ashok Leyland Ltd, are looking to buy a 26% stake in state-run defence equipment maker BEML Ltd.

What is strategic disinvestment or strategic sale?

- When the government decides to transfer the ownership and control of a public sector entity to some other entity, either private or public, the process is called strategic disinvestment.

- The Department of Investment and Public Asset Management (DIPAM) which comes under the Finance Ministry defines Strategic disinvestment as follows: “Strategic disinvestment would imply the sale of a substantial portion of the Government shareholding of a central public sector enterprises (CPSE) of up to 50%, or such higher percentage as the competent authority may determine, along with transfer of management control.”

- Strategic disinvestment is the transfer of the ownership and control of a public sector entity to some other entity (mostly to a private sector entity).

- Unlike the simple disinvestment, strategic sale implies a kind of privatization.

- Strategic disinvestment in India has been guided by the basic economic principle that the government should not be in the business to engage itself in manufacturing/producing goods and services in sectors where competitive markets have come of age.

- The economic potential of such entities may be better discovered in the hands of the strategic investors due to various factors, e.g. infusion of capital, technology up-gradation and efficient management practices etc.

Importance of Disinvestment

- Helpful in financing the increasing fiscal deficit in short term.

- For long-terms goals

- Financing large-scale infrastructure development.

- Investing in the economy to encourage spending

- Expansion and Diversification of the firm.

- Repayment of Government Debts: Almost 40-45% of the Centre’s revenue receipts go towards repaying public debt/interest

- Investing in social programs like health and education

- Assumes significance due to the prevalence of an increasingly competitive environment, which makes it difficult for many PSUs to operate profitably, leads to a rapid erosion of the value of the public assets making it critical to disinvest early to realize a high value.

- Strategic buyer/acquirer may bring in new management/technology/investment for the growth of these companies and may use innovative methods for their development.

Challenges of Disinvestments

- Sale of profit-making and dividend paying PSUs would result in the loss of regular income to the Government

- Chances of “Asset Striping” by the strategic partner, As most of the PSUs have valuable assets in the plant and machinery, land and buildings, etc.

- Strategic and National Security Concerns.

- Disinvestment affects labour forces’ social security.

- Concerns about cronyism.

- Using funds from disinvestment to bridge the fiscal deficit is an unhealthy and a short term practice.

- Complete Privatisation may result in public monopolies becoming private monopolies, which would then exploit their position to increase costs of various services and earn higher profits

- A majority stake sale done to another CPSE results in no real change in ownership, and is thus just hogwash.