In news

After Vodafone, India loses retrospective taxation case against Cairn

What was the arbitral tribunal’s award?

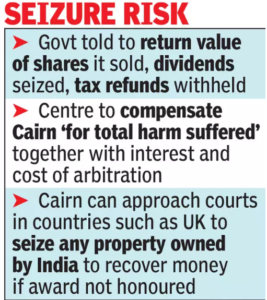

- An arbitration panel has unanimously ruled in favour of Cairn Energy Plc, holding that the Centre had “failed to uphold its obligations” under the UK-India bilateral investment treaty and international laws in seeking tax payments of Rs 10,250 crore from the company for its business reorganisation in the country.

- The arbitral tribunal awarded Cairn $1.2 billion (Rs 9,000 crore), plus interest and costs, after the ruling.

- The total damages are estimated at $1.4 billion for the government, which is studying the ruling.

- In the Cairn Energy case dating back to 2006-07, the three-member arbitration tribunal panel ruled that the government failed to accord the claimant’s investment “fair and equitable treatment” which was a violation of the treaty.

- The ruling is similar to the Vodafone case, which had led to a retrospective amendment of the law by then finance minister Pranab Mukherjee in 2012.

Background

- In 2014, Cairn faced a tax probe eight years after the IPO-related reorganisation. The income tax department asked Cairn to refrain from selling its remaining 10-odd% stake in Cairn India, which has since merged with Vedanta.

- The Indian tax authorities had claimed to have identified unassessed taxable income resulting from the intra-group share transfers undertaken in 2006 in preparation for the IPO.

- The notification referred to retrospective Indian tax legislation enacted in 2012, which the tax department had sought to apply to the 2006 transactions.

- In 2015, Cairn Energy Plc had commenced international arbitration proceedings against the government.

- The Cairn Energy case is the second most high-profile retrospective tax litigation.

- Previously, an arbitration court in the Hague had ruled that India’s Rs 22,000-crore demand from Vodafone Group Plc violated the bilateral investment treaty (BIT) between India and the Netherlands.

About Cairn Energy in India

- Cairn Energy began investing in India in the 1990s, becoming one of the first international companies to participate in the country’s oil and gas industry.

- While it became the operator of the Ravva oil and gas field on India’s eastern coast initially, it was in January 2004 that the company made its biggest hydrocarbon discovery of the Mangala oil field in Rajasthan. This was followed by discoveries of Bhagyam and Aishwarya oil fields nearby.

- In total, Cairn and its partners invested Rs 45,000 crore in India in various projects. It also built the Mangala Processing Terminal which still accounts for more than a third of the country’s crude oil production.

More About the Taxation Issue

- The Income Tax authorities had slapped Rs. 30,700 crore penalty on Cairn Energy.

- The assets held by Cairn India Holdings had to be transferred to a company registered in India, which was done by Cairn India (an Indian entity) buying the entire stake in Cairn India Holdings from Cairn U.K. Holdings.

- It involved a transfer of ownership of an Indian entity by way of an overseas transaction involving parties which did not fall under Indian tax jurisdiction.

- The tax authorities argued that though the deal was between two overseas entities, the shares derived their value from assets held in India, and hence were liable for capital gains tax.

- The government had retrospectively amended the law to allow indirect transfers which derive substantial value from assets located in India to be subjected to tax.

What is Retrospective Taxation?

- Retrospective tax means creating an additional charge or levy of tax by way of an amendment from a specified date in the past.

- Till date one of the major and most controversial retrospective amendments carried out was bringing indirect transfer under the tax bracket by Finance Act 2012.

- Retrospective tax is not so easily welcomed by taxpayers as it creates an additional levy on the transaction which is already concluded when the provisions of law were different.