In news

Ministry of Road Transport and Highways has published a draft notification, seeking comments from the public for the adoption of E20 fuel

Key highlights of the notification

- The notification facilitates the development of E20 compliant vehicles.

- It will also help in reducing emissions of carbon dioxide, hydrocarbons, etc.

- It will help reduce the oil import bill, thereby saving foreign exchange and boosting energy security.

Vehicle compatibility

- The compatibility of the vehicle to the percentage of ethanol in the blend of ethanol and gasoline shall be defined by the vehicle manufacturer and the same shall be displayed on the vehicle by putting a clearly visible sticker.

What is E20 fuel?

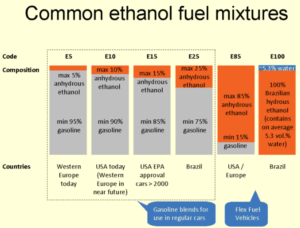

- E20 fuel, i.e, blend of 20% of ethanol with gasoline, as an automotive fuel and for the adoption of mass emission standards for this fuel

- The current permissible level of blending is 10% of ethanol though India reached only 5.6% of blending in 2019.

What is Ethanol?

- Ethanol is a biofuel and a common by-product of biomass left by agricultural feedstock such as corn, sugarcane, hemp, potato, etc.

- Ethanol fuel is ethyl alcohol, the same type of alcohol found in alcoholic beverages, used as fuel. It is most often used as a motor fuel, mainly as a biofuel additive for gasoline.

Ethanol Blending policy proposed in India:

- The proposed ethanol policy will focus on the key features of manufacturing, sale, utilization and blending.

- The policy has proposed a roadmap, which would “increase blending by states from 5 percent to 12-15 percent by 2026, and then increase to 20 percent by 2030.”

- Under the proposed policy, the government is likely to allow use of grain for ethanol and is likely to allow use of maize to supplement ethanol supplies from cane/molasses in the next two-three months.

- The government would fix ethanol prices by next quarter for maize and is likely to fix realistic transport rates at par with petrol to address the price issue.

- To fix transportation challenges the policy will enable creation of pipeline infrastructure for ethanol movement.

- On GST rates, the government is likely to reduce 28 percent GST on molasses, and reduce 18 percent on special denatured spirit to 5 percent. (GST on ethanol is 5 percent from July 2018).