The guidelines with respect to Priority sector will give a renewed impetus to important areas, start ups in a post pandemic environment. Further these reforms were long overdue, as the priority sector lending targets were overhauled in 1992 as part of broader financial sector reforms as part of LPG.

Static dimensions

- What is priority sector lending?

- RIDF

- PSL certificates

Current dimensions

- Changes proposed by the RBI

Content:

Changes proposed by the RBI:

- To address regional disparities in the flow of priority sector credit, higher weightage have been assigned to incremental priority sector credit in ‘identified districts’ where priority sector credit flow is comparatively low. ( As many as 184 districts with low per capita PSL credit flow will benefit from the RBI move).

- The targets prescribed for “small and marginal farmers” and “weaker sections” are being increased in a phased manner.

- Bank finance for start-ups, loans to farmers for installation of solar power plants for solarisation of grid connected agriculture pumps and loans for setting up Compressed BioGas (CBG) plants (loans up to a limit of Rs 30 crore) have been included as fresh categories eligible for finance under the priority sector.

- Loans up to Rs 50 crore can be availed by start-ups that are engaged in activities other than agriculture or micro, small and medium enterprises (MSMEs).

- Loan limits for renewable energy have been increased (doubled).

- For improvement of health infrastructure, credit limit for health infrastructure (including those under ‘Ayushman Bharat’) has been doubled. Upto a limit of Rs 10 crore per borrower for building healthcare facilities in Tier II to Tier VI centres have been allowed.

- Higher credit limit has been specified for Farmers Producers Organisations (FPOs)/Farmers Producers Companies (FPCs) undertaking farming with assured marketing of their produce at a predetermined price (loans subject to an aggregate limit of Rs 2 crore per borrowing entity).

Significance:

The revised guidelines will enable better credit penetration to credit deficient areas, increase lending to small and marginal farmers and weaker sections, boost credit to renewable energy, and health infrastructure. They are meant to align with emerging national priorities and bring sharper focus on inclusive development. A higher credit flow to the rural sector is expected to boost rural spending.

What is PSL?

- PSL is an important role given by the (RBI) to the banks for providing a specified portion of the bank lending to few specific sectors.

- It is essentially meant for an all round development of the economy as opposed to focusing only on the financial sector.

Priority Sector includes the following categories:

(i) Agriculture

(ii) Micro, Small and Medium Enterprises

(iii) Export Credit

(iv) Education

(v) Housing

(vi) Social Infrastructure

(vii) Renewable Energy

(viii) Others

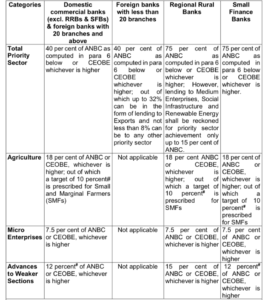

Targets /Sub-targets for Priority sector:

RIDF:

RIDF:

- The Rural Infrastructure Development Fund (RIDF) was set up by the Government in 1995-96 for financing ongoing rural infrastructure projects.

- The Fund is maintained by the National Bank for Agriculture and Rural Development (NABARD).

- The main objective of the Fund is to provide loans to State Governments and State-owned corporations to enable them to complete ongoing rural infrastructure projects.

- Domestic commercial banks contribute to the fund to the extent of their shortfall in stipulated priority sector lending to agriculture.

- Started with an initial corpus of Rs.2,000 crore, Rs.28,000 crore for was allocated in 2018-19 under RIDF XXIV.

- These funds are provided on a year-to-year basis by the Government of India.

Eligible Activities:

At present, there are 37 eligible activities under RIDF classified under three broad categories i.e.

- Agriculture and related sector

- Social sector

- Rural connectivity

Eligible Institutions:

- State Governments / Union Territories

- State Owned Corporations / State Govt. Undertakings

- State Govt. Sponsored / Supported Organisations

- Panchayat Raj Institutions/Self Help Groups (SHGs)/ NGOs (( provided the projects are submitted through the state Finance Department))

PSL certificates:

- Priority sector lending certificates (PSLCs) are certificates that are issued against priority sector loans for banks.

- The goal of PSLCs is to facilitate market efficiency, creating jobs in priority sectors.

- They allow banks to meet their targets and sub-targets when it comes to PSL by buying the instruments.

- PSLCs are important because they help banks protect against shortfall as they lend to minority populations and sectors that typically perform weaker.

- The lending certificates also incentivize, through surplus, to lend more to priority sectors.

- It improves the overall competitiveness of the economy and ensures the strength of market infrastructure.

- Explain the significance of RBI’s revised guidelines on Priority Sector lending (PSL).

Approach to the answer:

- Write briefly about PSL

- Write down the recent changes

- Write about its significance

- Conclude in 2-3 sentences on a positive note