In news– Government has allowed one-time option for those who applied for jobs advertised before December 22, 2003, the day NPS was notified but joined the service in 2004, when the NPS came into effect.

Key updates-

- The proposed option is available to the Central government employees enrolled under the NPS as they joined the service on or after January 1, 2004, the day the NPS came into effect, even though such posts were advertised before December 22, 2003, the day it was notified.

- The employees have time till August 31 2023 to opt for the OPS. The order will be applicable to Central Armed Police Force (CAPF) personnel and other Central government employees who joined the services in 2004 as the recruitment process was delayed due to administrative reasons.

- The employees’ contribution to the NPS will be credited to the General Provident Fund (GPF) of the individual.

- Several states such as Chhattisgarh, Rajasthan, Jharkhand and Himachal Pradesh have announced that they would restore the OPS.

- Till January 31, there were 23,65,693 Central government employees and 60,32,768 State government employees enrolled under the NPS.

- Except West Bengal, all States had implemented the NPS.

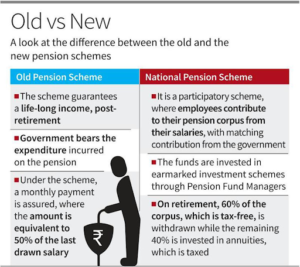

OPS vs NPS

- Under the OPS, retired employees received 50% of their last drawn salary as monthly pensions.

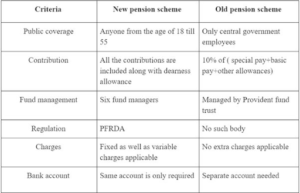

- However, NPS is a contributory pension scheme under which employees contribute 10% of their salary (basic + dearness allowance). The government contributes 14% towards the employees’ NPS accounts.

- In the OPS, it’s predetermined how much pension an employee will get linked to her last drawn salary and length of service.

- NPS, on the other hand, is a market-linked savings product that has a defined contribution.

- NPS allows an individual to invest in three types of funds –

- Safe, or conservative (allowing up to 10% investment in equity).

- Balanced, or moderate (up to 30% in equity).

- Growth, aggressive (up to 50% in equity).

- Safe, or conservative (allowing up to 10% investment in equity).

- The balance would be invested in corporate bonds or government securities. The volatility of NPS is usually compensated by the debt segment of the National Pension System.

- Annuity in the NPS allows employees to receive continuous income in later years after retirement.

- For example, in the case of OPS, if a government employee’s basic monthly salary at the time of retirement was Rs 10,000, she would be assured of a pension of Rs 5,000.

- Additionally, the monthly pension increases with hikes in dearness allowance announced by the government for serving employees.

- However, in the case of the NPS, the pension benefit is determined by factors such as the amount of contribution made, the age of joining, the type of investment, and the income drawn from that investment.

- Private employees can also choose to contribute to NPS.

- For example, if your current age is entered as 35 and the retirement age is 60, then the total investing period will be 25 years. Your monthly contribution towards NPS can be as low as Rs 1,000. The interest earned is on a monthly compounding basis.

Note:

- Dearness allowance is calculated as a percentage of an Indian citizen’s basic salary to mitigate the impact of inflation on people.

- Dearness allowances are revised twice a year, effective January 1 and July 1.

- A 4% dearness allowance hike would mean that a retiree with a pension of Rs 5,000 a month would see her monthly income rise to Rs 5,200 a month.