In news– NHAI has recently started accepting Electronic Bank Guarantees (E-BGs) and has also digitalized all its existing Bank Guarantees.

What are Electronic Bank Guarantees (E-BGs)?

- Bank Guarantee (BG) is a commercial instrument used as a legal contract in which a bank acts as a guarantor and undertakes an obligation to pay the beneficiary a certain amount of money specified in the guarantee if the debtor from the original contract does not fulfill his contractual obligations.

- An e-BG is a substitute to paper-based guarantees.

- It can be processed, stamped, verified and delivered instantly, compared with the time-consuming paper-based process.

- Paper-based bank guarantees typically take 3-to-5 day as the process involves physical pick up from the bank, courier to the beneficiary, stamping and re-verifying.

- An e-BG eliminates physical stamping and replaces it with e-stamping.

- The applicant and beneficiary can instantly view a bank guarantee.

- An e-BG also provides for enhanced security and reduces the possibility of fraud.

- HDFC Bank, in September 2022, issued the country’s first e-BG in partnership with National E-Governance Services Limited (NeSL).

Note:

NHAI is utilizing the E-BG services of National e-Governance Services Limited (NeSL), which facilitates reduction in physical paper movement, elimination of physical storage needs and easy access for Bank Guarantee life cycle events like invocation, renewal and closure.

National e-Governance Services Limited (NeSL)-

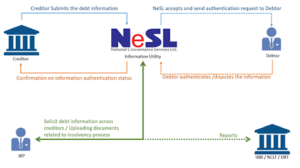

- NeSL is India’s first Information Utility and is registered with the Insolvency and Bankruptcy Board of India (IBBI) under the aegis of the Insolvency and Bankruptcy Code, 2016 (IBC).

- The company has been set up by leading banks and public institutions and is incorporated as a union government company.

- The primary role of NeSL is to serve as a repository of legal evidence holding the information pertaining to any debt/claim, as submitted by the financial or operational creditor and verified and authenticated by the parties to the debt.

NeSL works towards-

- Time-bound resolution by providing verified information to creditors and to Adjudicating Authorities that do not require further authentication.

- Default intimation to Creditors linked to a debtor when any creditor files a default against a debtor.

- Mitigation of information asymmetry between parties to a debt.

- Superior credit monitoring by creditors.

- An agreed statement of outstanding balance between parties to a debt.

- Facilitate all stakeholders of the IBC ecosystem by leveraging Information Technology to achieve objective of code.