In news– The International Monetary Fund (IMF) has published the October edition of World Economic Outlook (WEO).

The WEO report-

- The IMF publishes two WEOs each year (in April and October) as well as two updates (January and July) to policymakers around the globe.

- The latest WEO has said that the worst is yet to come for the world economy.

- It stated that “more than a third of the global economy will contract this year(2022) or next, while the three largest economies—the United States, the European Union, and China will continue to stall” and that “increasing price pressures remain the most immediate threat to current and future prosperity by squeezing real incomes and undermining macroeconomic stability.”

- Persistently high inflation and stalling growth is possibly the toughest policy challenge available. That’s because policy measures to contain inflation typically drag down growth even further while measures taken to boost growth tend to spike inflation.

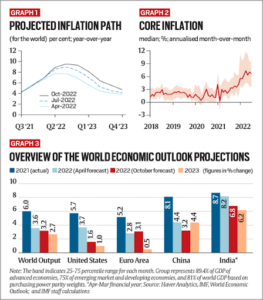

- The IMF has sharply cut the forecast for global growth — from 6.0 per cent in 2021 to 3.2 per cent in 2022 and 2.7 per cent in 2023.

- Barring the global financial crisis of 2008 and the sharp fall immediately after the Covid pandemic in 2020, this is the weakest growth profile for the world since 2001.

- Global inflation is now expected to peak at 9.5 per cent in late 2022. It is expected to remain elevated for longer than previously imagined and is likely to decrease to 4.1 per cent only by 2024.

- A particular worry here is the trajectory of core inflation — that is the inflation rate when prices of food and fuel are taken away. Core inflation typically rises and falls more gradually than inflation in food and fuel.

- In other words, food and fuel price inflation, which has typically spiked headline inflation, has now seeped through to core inflation and, as such, will take more time to go away.

- The IMF has also detailed several downside risks — or the reasons why things may get worse than projected.

- The first risk is that of policy miscalibration. Given the precarious situation facing most economies as well as massive uncertainty about what lies ahead, this is the biggest worry.

- Another big cause of worry is financial stability and its interplay with a stronger US dollar. Be it the pension funds in the UK or over-leveraged countries and firms elsewhere, sharp revision of interest rates will likely expose the weakest links in the global credit chain.

- Lastly, there are geopolitical risks associated with the war in Ukraine. A worsening, or prolonging of the conflict can make all the above-mentioned pressures worse.

Status of India-

- At first glance, India appears better placed. India’s GDP growth rate is better and inflation is not as high.

- But these metrics hide that in absolute terms, India is barely out of the contraction suffered in 2020, that it was home to the most people (5.6 crore, according to World Bank) pushed below abject poverty in 2020 or that crores are unemployed.

- Moreover, if RBI cuts its growth rate forecast in April (7.2 per cent) by the same measure as IMF has (1.4 per cent points), India’s growth in 2022-23 will be 5.8 per cent.

- The threat to India comes from following sources:

- Higher crude oil and fertiliser prices will spike domestic inflation.

- Global slowdown will hurt exports, dragging down domestic growth and worsening the trade deficit.

- A strong dollar will put pressure on the rupee’s exchange rate, which will likely result in reducing our forex reserves and reducing our capacity to import goods when the going gets tougher.

- Also, given the low demand among most Indians, the government might be forced to spend more towards providing basic relief in the form of food and fertiliser subsidies. This will worsen the government’s financial health.