In news–The Reserve Bank of India(RBI) has recently released the Digital Payments Index (RBI-DPI) for March 2022.

Digital Payments Index (RBI-DPI)-

- The Reserve Bank had announced construction of a composite RBI-DPI with March 2018 as base to capture the extent of digitisation of payments across the country.

- The RBI-DPI index has demonstrated significant growth representing the rapid adoption and deepening of digital payments across the country in recent years.

- The index for March 2022 stands at 349.30 as against 304.06 for September 2021, which was announced on January 19, 2022.

- Among the digital modes of payments, the number of transactions using Real Time Gross Settlement (RTGS) increased by 30.5 percent during 2021-22.

- Payment transactions carried out through credit cards increased by 27 per cent and 54.3 per cent in terms of volume and value, respectively and transactions through debit cards decreased by 1.9 per cent in terms of volume, though in terms of value, it increased by 10.4 per cent.

- Prepaid Payment Instruments (PPIs) recorded an increase in volume and value terms by 32.3 per cent and 48.5 percent, respectively.

Parameters of DPI-

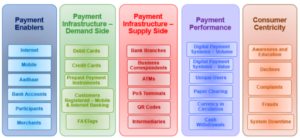

- The RBI-DPI comprises 5 broad parameters that enable measurement of deepening and penetration of digital payments in the country over different time periods. These parameters are-

- Payment Enablers (weight 25%).

- Payment Infrastructure – Demand-side factors.

- Payment Infrastructure – Supply-side factors (15%).

- Payment Performance (45%).

- Consumer Centricity (5%).

- Each of these parameters have sub-parameters which, in turn, consist of various measurable indicators.

- The RBI-DPI was constructed with March 2018 as the base period, i.e. DPI score for March 2018 is set at 100.

Source: Business Standard